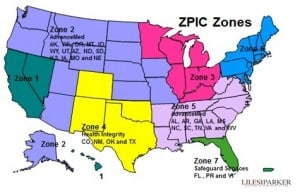

(March 25, 2010): The Recovery Audit Contractor (RAC) program is an integral part of the Centers for Medicare & Medicaid Services’ (CMS’) "benefit integrity" efforts which seek to identify and recoup alleged overpayments paid to Medicare providers. Similarly, Program SafeGuard Contractors (PSCs) have been actively auditing Medicare providers and suppliers around the country. While the RAC program is still being expanded in many parts of the country (to cover not only hospitals but also other providers and types of Medicare claims), the PSC program is in the process of being replaced by Zone Program Integrity Contractors (ZPICs) ZPICs are already active in many areas and are actively conducting Medicare audits of physicians, home health agencies, hospices, DME companies, therapy clinics, chiropractors and other small to mid-sized health care providers. Despite the "hype" surrounding RACs, at this time, ZPICs represent a significantly greater risk to non-hospital providers than do RACs or PSCs. The purpose of this article to examine a number of the differences between these various Medicare audit contractor programs.

I. What Are The Chances of Your Practice Being Reported by a ZPIC or RAC to DOJ for Possible Fraud?

While both Medicare audit contractor programs are designed to "find and prevent waste, fraud and abuse in Medicare," the fact is that to date, ZPICs have been much more likely than RACs to report possible incidents of "fraud" that are identified while conducting Medicare audits. Frankly, it makes sense. RACs make money by identifying alleged overpayments – not by making a fraud referral to law enforcement. Notably, as a result of recent criticism by HHS-OIG, CMS will be requiring RACs to be much more diligent in the future about making referrals to law enforcement when it appears that a health care provider’s conduct represents fraud rather than a mere overpayment. CMS has provided training to RACs on how to identify fraud in the near future. Importantly, a RAC denial of claims which results in a provider repayment will not necessarily prevent HHS-OIG from investigating and making a referral to DOJ for possible prosecution, as appropriate, if there are allegations of fraud or abuse arising out of the alleged overpayment.

Notably, recent letters by ZPICs conducting Medicare audits in South Texas and in other parts of the country have been seeking copies of business related records (copies of contracts, agreements with Medical Directors, lease agreements and more), along with its request for claims-related medical documentation. Importantly, the contractor is assessing the provider's business relationships to help verify that referral and other business relationships do not violate the Federal Anti-Kickback Statute or Stark Law. To reduce the possibility of civil or criminal liability, it is essential that Medicare providers take affirmative steps to better ensure that their practices are compliant with applicable statutory and regulatory requirements. 2011 will be the "Year of Compliance." All providers, regardless of size, should take steps to implement an effective Compliance Program. Should you not have a compliance program in place, give us a call -- we can help.

II. What is the Difference Between a ZPIC and a PSC?

Representatives of both a ZPIC and Program Safeguard Contractor (PSC) will argue that they are not "bounty hunters" in the Medicare audit process. A ZPIC is are not paid contingency fees like RACs and are paid directly by CMS on a contractual basis. Nevertheless, common sense tells us that if ZPICs aren’t successful at identifying alleged overpayments through Medicare audits, the chances of a particular contractor getting their contract with CMS renewed are pretty slim. Experience has shown that both a ZPIC and a PSC don’t always appear to strictly adhere to medical review standards established by Medicare Administrative Contractors (MACs) and approved by CMS. In our opinion, there appear to have been cases where these contractors applied their own unwritten standards, often denying claims based on conjecture and speculation rather than a strict application of the applicable LCD or LMRP.

In any event, over the last year, we have seen ZPIC and PSC auditors readily place health care providers on pre-payment review, conduct post-payment Medicare audits, and recommend suspensions of payment. Additionally, in many cases they have been extrapolating the alleged damages based on a sample of claims reviewed. Finally, as discussed above, identified instances of potential fraud are being referred by a ZPIC or a PSC to HHS-OIG for possible investigation, referral for prosecution and / or administrative sanction.

III. What Sources of Coding / Billing Data are Used by ZPICs During Medicare Audits?

ZPICs are required to use a variety of techniques, both proactive and reactive, to address any potentially fraudulent practices. Proactive techniques will include the ZPIC IT Systems that will combine claims data (fiscal intermediary, regional home health intermediary, carrier, and durable medical equipment regional carrier data) and other source of information to create a platform for conducting complex data analyses. By combining data from various sources, ZPICs have been able to assemble a fairly comprehensive picture of a beneficiary’s claim history regardless of where the claim was processed. The primary source of this data is reportedly CMS’ National Claims History (NCH) database.

IV. How do ZPICs Conduct Medical Reviews?

During their Medicare audits, ZPICs conduct medical reviews of charts to determine, among other things, whether the service submitted was actually provided, and whether the service was medically reasonably and necessary. Based upon their findings, ZPICs may approve, downcode or deny a claim. To date, we have never seen a ZPIC conclude that a claim should have been coded at a higher level, only a lower level. Regrettably, ZPICs are not required to have a physician review a claim in order to deny coverage. In most of the cases on which we have worked, the contractor’s medical reviewer has been a Registered Nurse. While some Federal courts have found that a treating physician’s opinion should be given paramount weight, others have ruled that the opinion of a treating physician should not be given any special consideration. Generally, ZPICs have completely disregarded the "Treating Physician Rule," despite the fact that a patient’s treating physician was the only provider to have actually seen and assessed the patient at issue.

V. How Should You Respond to a ZPIC Medicare Audit?

In responding to a ZPIC audit, it is important to remember that although they may not technically be "bounty hunters," in our opinion, they are in the business of finding fault. Moreover, they are quite adept at identifying "technical" errors, many of which they will readily cite when denying your Medicare claims. Unfortunately, it is not at all uncommon for a ZPIC to find that 75% -- 100 % of the sample of claims reviewed did not qualify for coverage and payment by Medicare. After extrapolating the damages to the universe of claims at issue, health care providers often find that they are facing alleged overpayments of between $150,000 and several million dollars. In many cases, the assessment is far in excess of the provider's ability to pay. As such, the administrative appeal becomes a "bet the farm" matter for the health care provider. If the assessment remains, the provider will have no choice but to declare bankruptcy.

It is also important to remember that ZPIC enforcement actions are not limited to merely overpayment assessments. In recent months, ZPICs have been increasingly conducting unexpected site visits of health care provider's offices and facilities, often requesting immediate access to a limited number of claims and the medical records supporting the services billed to Medicare. Typically, they then require that a provider send supporting documentation covering a wider list of claims within 30 days of their visit. In other cases, should a ZPIC identify serious problems when reviewing the medical records requested, they may recommend to CMS that the provider's Medicare billing privileges be suspended. From a practical standpoint, few providers are diversified (in terms of payor mix) to the point that they can easily do without Medicare reimbursement. The practical effect of a Medicare suspension is therefore that the provider cannot continue in business throughout the 180-day initial period of suspension typically imposed by CMS. Finally, in a limited number of cases, after a ZPIC or PSC has visited an office, the provider will subsequently learn that the contractor has recommended that the provider's Medicare number be revoked. In a fairly recent case we are aware of (not involving a client of the Firm), the contractor claimed that the provider failed to cooperate, a clear violation of the provider's "Conditions of Participation" with Medicare. As a result, the contractor recommended (and CMS approved) the revocation of the provider's Medicare number. Short of exclusion from participation in the Medicare program, this is arguably the most serious and far-reaching administrative action that can be taken against a Medicare provider.

In light of the seriousness of the situation, regardless of whether you are contacted by a RAC, a ZPIC or a PSC, you must take great care when responding to Medicare audits. Administrative enforcement actions can be extraordinarily serious. Therefore, is essential that you engage an experienced attorney and law firm to represent your interest.

Read more about ZPIC Medicare audits.

Robert W. Liles, J.D., M.S., M.B.A., is a health lawyer with Liles Parker PLLC. Liles Parker has offices in Washington, DC, Houston, TX and San Antonio, TX. Prior to entering private practice, Mr. Liles served as an Assistant U.S. Attorney. He now represents health care providers around the country in connection with administrative, civil and criminal health law issues. He has extensive experience defending providers in audits by a ZPIC, PSC or another Medicare / Medicaid contractors. For a complimentary consultation, please call: 1 (800) 475-1906.