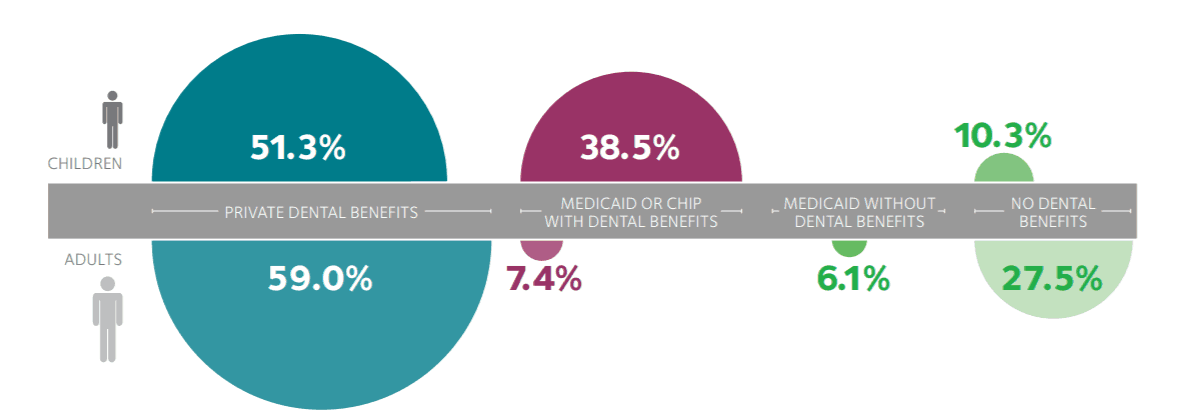

(January 3, 2019): Slowly but surely, the percentage of adults and children with dental insurance coverage benefits has gradually climbed. These increases have been driven, at least in part, by several factors. First, despite the fact that traditional Medicare does not cover routine dental services, a number of Medicare Advantage plans are now offering coverage for routine dental procedures such as cleanings and fillings. Second, approximately 37 states have expanded their Medicaid plan’s eligibility requirements. Notably, 25 of these states now provide at least limited dental benefits for adult Medicaid beneficiaries.[1] Finally, a growing number of employers are now offering supplemental dental policies at affordable prices for their staff and families. Collectively, the American Dental Association’s (ADA’s) Health Policy Institute has estimated that approximately 89.7% of children and 72.5% of adults currently have some level of dental benefits coverage.[2]

Aetna is one of the largest insurance payors currently offering dental service plans. In fact, more than 12.7 million individuals now have coverage for dental services through Aetna.[3] The payor has developed dental benefits packages that are offered by a number of Medicare Advantage, Medicaid and private plans around the country. Not surprisingly, Aetna’s “Special Investigations Unit” (SIU) has been aggressively working to identify and address suspected instances of dental improper billing practices, fraud and abuse. The purpose of this article is to provide an overview of Aetna’s dental claims program integrity auditing practices and discuss steps that your dental practice can take to reduce its level of risk and hopefully avoid the imposition of a significant overpayment by the payor.

I. Aetna SIU Dental Enforcement Activities:

Aetna employs a core team of investigators to review and assess questionable dental claims billed to one or more of their programs. In addition to cases involving allegations of improper billing, the SIU is also responsible for investigating possible instances of health care fraud and abuse. From a business standpoint, Aetna’s SIU has proven to be financially prudent. Aetna’s SIU claims that for every dollar spent on enforcement, it recovered and / or saved the payor fifteen dollars. As you can imagine, a return on investment of 15 to 1 provides significant motivation for Aetna to further expand its SIU’s investigation efforts.

From a practical standpoint, Aetna’s enforcement authorities are limited to taking administrative action against a dental provider when wrongdoing has been identified. This may include the assessment of an overpayment and / or termination from one or more of Aetna’s participating provider programs. In some instances, Aetna may also report a dental provider to the “National Practitioner Data Bank (NPDB).” [4] In addition to dental professionals having the ability to “self-query,” it is important to remember that when a dentist is reported to the NPDB, the information is also made available to:

- Hospitals.

- Health Care Entities with Formal Peer Review Functions.

- Health Plans.

- Professional Societies with Formal Peer Review Functions.

- Quality Improvement Organizations.

- State Licensing and Certification Authorities State Law Enforcement Agencies.

- State Medicaid Fraud Control Units.

- State Agencies Administering or Supervising the Administration of a State Health Care Program.

- Agencies Administering Federal Health Care Programs, Including Private Entities Administering Such Programs Under Contract.

- Federal Licensing or Certification Agencies.

- Federal Law Enforcement Officials or Agencies.

Unfortunately, after being reported to the NPDB, many dentists and other health care providers have suffered the proverbial “death by a thousand cuts.” After Aetna or another payor takes a reportable adverse action against you and files the report with the NPDB, it is quite common for other payors to initiate their own reviews of your dental practices and claims. This often results in additional adverse actions being pursued by other payor networks. Notably, most payor participation agreements include a requirement that you notify them with 30 – 60 days (depending on the payor) of any adverse action taken against you or your license. In recent years, the mere failure to file this report in a timely fashion has been cited as justification by some payors for terminating a provider’s participation in their network.

II. Examples of Criminal Cases Brought Against Dentists in Connection with Fraudulent Aetna Claims:

It is important to keep in mind that in addition to offering private dental insurance products, the company has greatly expanded its Medicare Advantage, Medicaid and Medicaid Advantage programs footprint. Additionally, the payor offers a number of dental coverage programs through the Federal Employee Health Benefits Programs (FEHBP). These relationships have further strengthened Aetna’s close working relationship with Federal and State prosecutors, investigators, auditors and agents around the country. Why does this matter? It is important to keep in mind that Aetna’s SIU will not hesitate to refer cases involving fraud and abuse to law enforcement. Several cases brought against dentists for defrauding Aetna and other private payors include the following:

Virginia. In this case, a Virginia dentist was sentenced to 25 months in prison for illegally dispensing controlled substances and for using the identity of another dentist to fraudulently bill Aetna for more than $160,000 in dental services he provided to family members.

Virginia. In this case, the owner / operator of a dental practice was sentenced to 30 months in prison for defrauding Medicaid and four dental insurers of approximately $783,000. In this case, the defendant dentist’s fraud scheme included: (1) the fraudulent billing of dental services to Medicaid and other payors for dental services that were never rendered, some of which were billed while the dentist was out of the country; (2) the improper use of incorrect CDT billing codes that resulted in higher bills than were justified by the actual dental services provided; (3) the fraudulent “backdating” of dental services in an effort to have certain dental services covered by the insurance payor AFTER the patient’s insurance coverage had been terminated.

New Jersey. In this case, a New Jersey dentist pleaded guilty to theft after fraudulently altering the dates of service when dental work for provided. The dentist admitted that he had falsified the dates of service in an effort to avoid contractual date restrictions set out in the patient’s dental insurance policies. After pleading guilty, he faced up to five years in state prison.

III. How Are Dentists and Their Practices Targeted by Aetna’s SIU?

Aetna SIU reviews and audits of dental claims can arise in a number of ways. In most cases, Aetna’s SIU identifies audit target based solely on the results of data-mining, without anyone actually taking the time to review any of your dental practice’s patient records. This type of review examines the CDT coding and billing information submitted by the dental practice and takes into account the provider’s billing patterns and those of his or her peers and other dental providers. Once a target is identified, Aetna’s SIU will normally advise a dental practice that a review of relevant patient dental records is necessary in order to determine whether or not an overpayment exists. In addition to data-mining, Aetna’s SIU may also initiate an audit based on:

- A prior history of alleged overpayments.

- An adverse report filed against a dental professional on the NPDB.

- Complaints from beneficiaries and their families.

- Actions taken by State Dental Boards.

- Actions taken by Federal and / or State prosecutors and regulators.

When Aetna’s SIU suspects that a dental provider is committing fraud, it will generally contact one or more of the dentist’s Aetna patients to confirm whether certain dental services were actually rendered. Many of our clients first heard that Aetna was conducting an audit of their claims from one of the practice’s patients.

IV. Examples of Improper Dental Coding and Billing Practices:

Examples of improper claims cited by Aetna SIU investigators have included:

- Billing for dental services that are not considered medically necessary after reviewing the beneficiary’s dental records.

- Billing for radiographs when no record of the x-rays can be produced.

- Billing for dental services that have been based on radiographs when a review of the x-rays does not show that the services were medically necessary.

- Billing for dental services that are not covered due to contractual date restrictions.

- Billing for dental services under the identity of a credentialed dentists when, in fact, the dental services were provided by a non-credentialed dentist.

- Billing for dental services that were not provided.

- Billing for dental services that qualify for coverage, when other non-covered dental services were actually provided.

- Failure to collect contractually required co-payments and deductibles from patients.

- Claims that are submitted with falsified dates of services in order to avoid denial because the services were provided after a patient’s period of coverage.

- Improper unbundling of claims for dental services that are supposed to be billed together.

V. Steps That You Can Take to Reduce Your Level of Risk:

As with any payor, it is essential that dentists and dental practices submitting claims to Aetna for coverage and payment take the time to review the terms of their participation agreement and understand the specific contractual limitations that may apply to a specific beneficiary’s plan. In recent years, compliance plans have become an essential program integrity tool utilized by dentists and dental practices. Compliance programs aimed at reducing, preventing, and deterring fraudulent and improper conduct are at the forefront of the health care industry’s goals. These programs can also benefit dental practices by helping them avoid costly litigation and by streamlining their business operations. Additional benefits of implementing a compliance program include:

- Proactive approach. A compliance program is a proactive way to make sure that your dental practice is meeting all ofits statutory and regulatory obligations.

- Evidence of good faith. The existence of a compliance program serves as evidence of a good faith effort to comply with the law in the event your dental practice becomes the subject of an investigation.

- Sentencing guidelines. In the event of criminal prosecution, the existence of a compliance plan is favorably considered under the sentencing guidelines. Your dental practice and its staff will also likely benefit from its compliance efforts if civil or administrative proceedings are pursued by the government or private payors such as Aetna.

- Minimize mistakes. An effective compliance program can speed-up and optimize the proper payment of your dental claims. It can also minimize the likelihood that you will submit incorrect dental claims to insurance companies for payment.

VI. Conclusion:

If your dental practice is audited by Aetna or another payor, it is important that you contact qualified health law counsel before you respond to the payor’s request for documentation. You need to put your best foot forward when responding to an audit. We can assist you in that regard.

The attorneys at Liles Parker have extensive experience representing dentists and dental practices in connection with dental claims audits. Notably, the attorneys working on your dental case are also Certified Professional Coders and have successfully passed the certification exam of the American Association of Professional Coders.

- [1] Henry J. Kaiser Family Foundation, “Current Status of State Medicaid Expansion Decisions,” as of December 28, 2018.

- [2] ADA Health Policy Institute, Dental Benefits Coverage in the U.S.

- [3] Aetna Facts, can be found at: https://www.aetna.com/about-us/aetna-facts-and-subsidiaries/aetna-facts.html

- [4] The types of actions that must be reported to the National Practitioner Data Bank are quite extensive. Notably, reportable actions are limited to allegations of malpractice. A wide scope of other adverse actions against a professional licensee (such as a dentist) must also be reported.