(September 15, 2023): Medicaid funding for personal care services allows those that need help for activities of daily living to remain in their homes and receive care from qualified individuals rather than have to live in institutional settings.[1] This is also a benefit to Medicaid, as it reduces the demand and costs for institutional and nursing facility care. Unfortunately, these programs have been plagued with a wide variety of compliance problems, often resulting in administrative, civil and even criminal exposure for both agencies and the personal care attendants they employ. This article discusses the efforts of several state Medicaid Fraud Control Units (MFCUs), along with those of the U.S. Department of Health and Human Services (HHS), Office of Inspector General (OIG) to investigate and prosecute instances of fraud by personal care agencies and attendants. Additionally, this article will focus on steps you can take to reduce the risks faced by you and your agency.

I. Overview of Medicaid Fraud and Improper Payments:

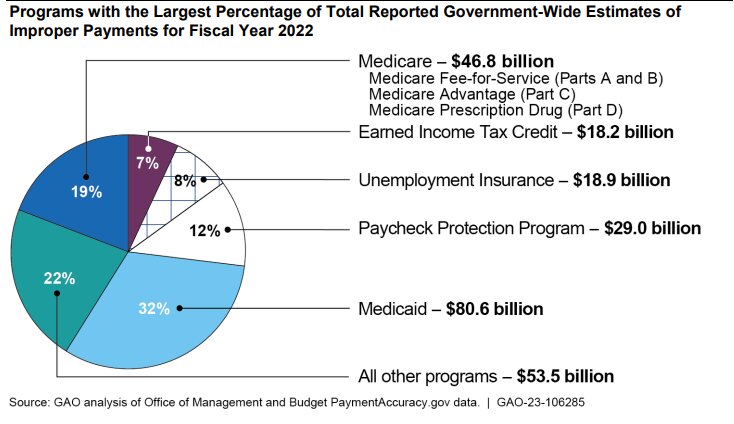

Medicaid fraud and instances of improper billing are out of control. A recent report by the U.S. Government Accountability Office (GAO) concluded that out of 82 programs funded all, or in part, by the federal government, Medicaid paid out the most in improper payments during Fiscal Year (FY) 2022 – more than $80 billion.[2] While a number of federal agencies may be involved in the investigation of Medicaid fraud, at the state level, improper billing and false claims are investigated by the 53 individual MFCU offices in the United States (all 50 states, District of Columbia, Puerto Rico and the U.S. Virgin Islands). These offices work closely with the OIG and are jointly funded by both federal and state governments. A case usually begins when a referral is sent by either a member of the public or flagged by the office through data mining.[3]

State and / or federal criminal investigations into the fraudulent submission of claims typically lead to criminal conviction, monetary recovery, and or OIG exclusion of both individuals and agencies from Federally funded health care programs.

II. Overview of Medicaid Consumer-Directed Personal Care Services System:

Medicaid is primarily funded by the federal government and distributed to individual states for their governments to administer and regulate.[4] For a Medicaid recipient to receive personal care services, they must first be approved by a physician for an appropriate care plan. The state must then determine the recipient’s required level of care and eligibility. Once the state has determined eligibility, it will authorize a plan of care to authorize the services. Federal law allows large deference and “considerable flexibility” for each state to establish and oversee their own personal care services program. The most common state personal care program is through 1915(c) waivers, also known as a “Home and Community-Based Services Waiver” (HBCS), which allows for recipients to be cared by a personal care attendant that provides services in the beneficiary’s own home and / or communities, thereby helping to maintain the beneficiary’s independence, and reduce the need for costly institutional care.

-

Example: Virginia’s Medicaid Personal Care Services Waiver System.

It is important to keep in mind that the requirements to provide personal care services AND to participate in a specific program vary from state to state. For example, Virginia has merged their two 1915(c) waivers into their current waiver, the “Commonwealth Coordinated Care Plus Waiver” (CCC+),[5] which serves more than 260,000 Virginia Medicaid recipients.[6] The CCC+ waiver covers personal care services for children, the elderly and disabled recipients, allowing beneficiaries to opt out of facility care through their home and community-based service waivers.

Virginia is also one of the several states that allows recipients to designate an adult family member as their personal care attendant. Once the family member enrolls in the consumer-directed option,[7] the recipient will undergo an evaluation to determine the need for in-home care. Then the family member will typically undergo care training and acquire credentials. Depending on the state, family member care attendants may be required to become “employed” with a personal care services agency so that payments can be processed, and work hours can be verified. For obvious reasons, the consumer-directed model greatly expanded during the COVID pandemic. Many beneficiaries (and their families) did not want outsiders in their homes during the pandemic. Unfortunately, Medicaid investigators have identified multiple cases in recent years where family members are alleged to have falsified records, billed for services that were not rendered, etc. As a result, state law enforcement has devoted considerable resources to investigating these cases.

-

What is the Difference Between Personal Care Services and Home Health Services?

One question that frequently arises is “What is the difference between personal care services and home health services?” To start, personal care attendants are primarily engaged to provide basic assistance with respect to activities of daily living. They are not hired and are not required to provide “skilled” nursing services. In contrast, home health agencies providing services to Medicaid beneficiaries are required to meet a number of federal training requirements and are authorized to provide skilled nursing support services to their patients. Although home health aides may provide support with activities of daily living, the non-skilled work they perform is ancillary to the skilled nursing services being performed by other home health agency staff. Personal care services cannot be billed as Medicaid or Medicare home health services when home health skilled nursing services are not authorized in the Plan of Care.[8]

III. Review of the Personal Care / Home Care Enforcement Landscape:

Over the past decade, the demand for personal care service programs has increased and is expected to grow as the country’s aging population increases and more people have opted for in-home care. As a result, Medicaid spending has trended away from long term care in institutions and towards home and community-based services. In 2016, the OIG released a report on 23 states’ Medicaid personal care service programs based on data from 2006-2012.[9] The report concluded that the existing controls to monitor for fraud and improper payments to Medicaid from personal care service agencies and attendants were ineffective and highlighted the need for stronger enforcement from MFCU agencies as the number of personal care service recipients grows. Unfortunately, not much has changed from 2006 to the present. As discussed below, personal care attendants and agencies are prime targets for investigation and prosecution.

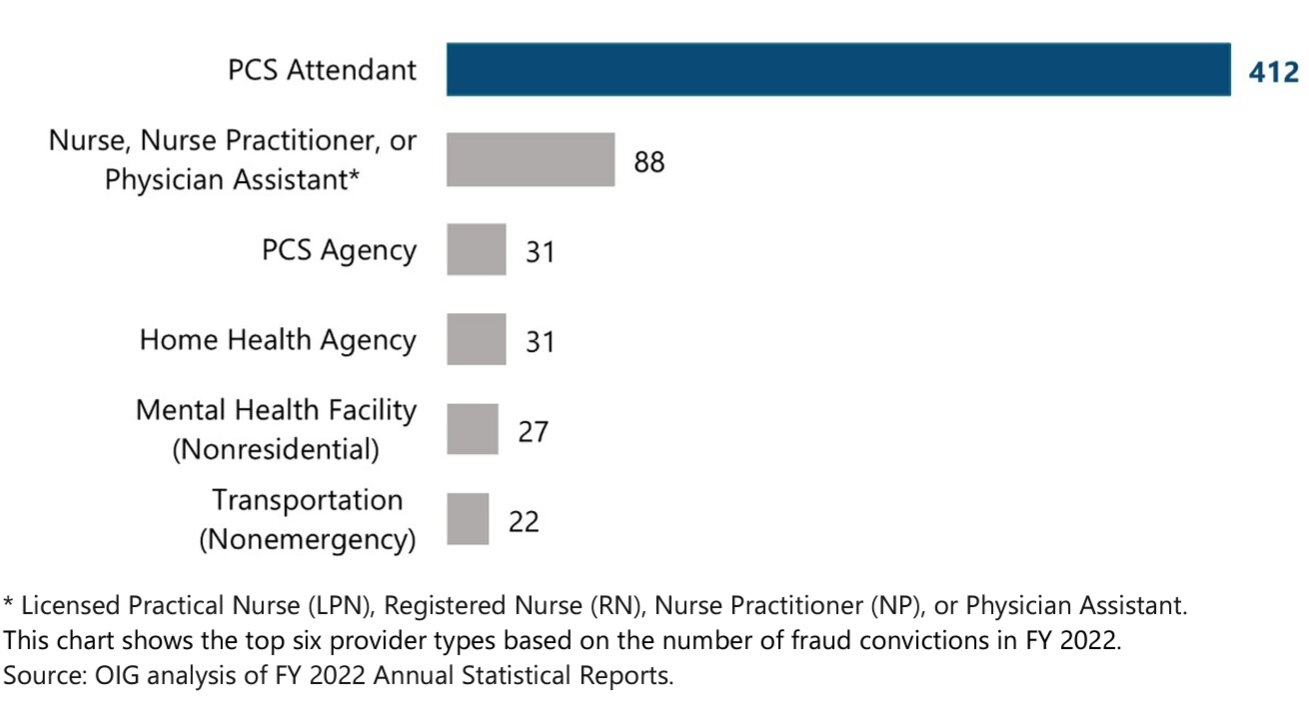

When reviewing Medicaid prosecutions handled during 2022, the OIG found that personal care / home care attendants and agencies were two of the top targets of MFCUs around the country. In fact, criminal investigations of personal care attendants accounted for 44% of all Medicaid fraud convictions in 2022.

Convictions of Personal Care Services (PCS) attendants for Medicaid Fraud Were Significantly Higher than for any Other Provider Type in FY 2022.[10]

IV. Case Examples of Civil and Criminal Enforcement for Improper Billing of Personal Care Services:

At the outset, it is important to keep in mind that both federal and state law enforcement agencies have jurisdiction to prosecute civil and criminal violations of Medicaid funded personal care services. On the state side, several jurisdictions stand out in terms of criminal prosecutions of personal care attendants accused of Medicaid fraud. Out of 53 MFCUs, the Commonwealth of Virginia is far and away the most active jurisdiction. Other jurisdictions actively investigating and prosecuting personal care fraud include Missouri and the District of Columbia. Examples of the cases pursued in these jurisdictions include:

Virginia. In one recent case, two defendants pleaded guilty to one count of Medicaid fraud. Both defendants fraudulently billed for personal care services when the defendants were working at other jobs or were out of the country. Both defendants were sentenced to five years in prison. One defendant was ordered to pay approximately $22,000 in restitution while the second defendant was ordered to pay approximately $17,000 in restitution.

Virginia. In this case, a personal care aide was prosecuted for Medicaid fraud in connection with her falsification of timesheets. During one of the falsified periods when the defendant was allegedly providing attendant services, the beneficiary was in the hospital. During another period, the defendant billed for services supposedly provided while the beneficiary was undergoing a sleep study outside of her home. The defendant was convicted and was sentenced to 57 months in prison with 57 months suspended. She was also ordered to pay $5,000 in restitution.

District of Columbia. In this case, a personal care aide was criminally prosecuted for health care fraud in connection with her falsification of timesheets documenting activities of daily living services allegedly provided to DC Medicaid beneficiaries. As part of her fraud scheme, the defendant allegedly paid kickbacks to beneficiaries and submitted timesheets for services that she did not provide. The government also alleged that the defendant billed for services during a period when she was out of the country. The defendant plead guilty to the charges and agreed to pay more than $316,000 in restitution. At the time of her plea, she faced a likely range of 18-24 months in prison and a fine of up to $250,000.

District of Columbia. According to the government, the defendant in this case was employed as a personal care aide and was hired to provide personal care aide services to District of Columbia residents who need assistance performing activities of daily living. The defendant was prosecuted in federal court and ultimately pleaded guilty to one count of health care fraud. As in the earlier case, the defendant allegedly submitted false timesheets claiming that he provided personal care services when he was traveling outside the United States on eight different trips. Earlier this year, the defendant was sentenced to 20 months in prison and was ordered to pay more than $733,000 in restitution.

Missouri. In this case, the Missouri Attorney General’s Office alleged that the defendant agency submitted claims for personal attendants or services without actually verifying that the agency’s employees were providing the personal care services being billed to Medicaid. Some of the claims for personal care services billed were for times when the Medicaid beneficiary was alleged to have been hospitalized or admitted to a nursing home facility. In settling the case, the defendant was ordered to pay $50,000 to Missouri’s Medicaid Fraud reimbursement fund.

The decision of whether to pursue a case at the federal or state level often hinges on which agency identified and investigated the fraud, the amount in controversy and various other factors considered by prosecutors reviewing a case. When handled at the State level, as long as there is no indication that fraud was involved, allegations of improper billing are likely to be resolved administratively. To the extent that it appears that the improper conduct was conducted “knowingly,” a state Assistant Attorney General may also seek assert penalties and damages under the state’s False Claims Act. In recent years, a number of states have increased the number of criminal enforcement actions taken in personal care fraud cases. When handled at the federal level, the government’s options for addressing wrongful conduct typically involve civil or criminal enforcement.[11]

V. Personal Care Services (PCS) -- Risk Areas:

Personal care services are indispensable for many beneficiaries, especially for those with disabilities and the elderly, who require assistance with daily living activities. In most states, Medicaid has stepped in to address these beneficiary needs. Despite these efforts, personal care services have continued to be a compliance headache for many state regulators. Some of the common risk areas identified when investigating personal care fraud and improper billing practices include, but are not limited to:

- Improper Payments. One of the most significant risks associated with Medicaid billing for personal care services is the potential for improper payments. These can arise due to inadvertent errors, such as clerical mistakes, or more nefarious causes such as fraud and abuse. For example:

- Personal care attendants may bill for services that were not rendered.

- Personal care agencies may attempt to upcode services and represent that the services qualified as home health aide services rather than merely the services of a personal care attendant.

- Audits of personal care services will often involve a review of attendant timesheets. Time increments claimed by an agency must be supported by documentation by the personal care worker that matches the claim.

- Illegal Kickbacks. Regrettably, there have been instances where a personal care attendant or agency has given cash or other items of value to a Medicaid beneficiary in order to secure the business. Alternatively, in some instances, the services were never provided, and the personal care provider split the monies received with the purported beneficiary.

- Ineligible to Provide Medicaid Personal Care Services. Unfortunately, many personal care agencies do not properly screen their employees to ensure that each individual has not been excluded from participating in federal health benefits programs. For more information in this topic, see www.exclusionscreening.com.

- Attendants Have Not Been Properly Trained. While there are not currently any federal requirements for personal care attendants, many states have imposed such requirements. Failure to properly document that training has been provided to personal care workers can be quite problematic in the event of an audit. If qualified training cannot be verified, a Medicaid auditor will likely deny payment and seek to recover any monies that have been improperly paid.

- Billing for Medically Unnecessary Services. Providers may bill for services that are not medically necessary for the beneficiary. This can happen when the provider is trying to maximize their profits, or when they are not properly trained in the types of services that are covered by Medicaid.

- Inadequate Documentation. An integral part of ensuring appropriate billing and service delivery is maintaining comprehensive and accurate documentation. The lack of adequate documentation can lead to difficulties in verifying whether services were provided as billed or if they were medically necessary. Proper documentation, including service logs, care plans, and verification of service delivery, is critical to validate the claims and to ensure that beneficiaries receive the necessary care. Providers are required to submit documentation to support their claims for personal care services. This documentation must be accurate and complete. If the documentation is false or incomplete, the claim may be denied or the provider may be subject to penalties.

- Service Delivery Risks. While improper billing is a concern, the nature of personal care services also poses risks in terms of service delivery. Given that many services are delivered in private settings, there is potential for non-compliance with care plans. This can lead to beneficiaries not receiving the full suite of services they require, resulting in unmet needs and potentially deteriorating health outcomes. Ensuring that services are delivered as intended is a challenge, requiring robust oversight and verification mechanisms.

- False Statements and Misrepresentations. Regardless of whether an investigation is being handled by state or federal authorities, it is imperative that you do not make any false or misleading statements to investigators. On the federal side, making a false statement or concealing a material fact could result in you may being criminally prosecuted under 18 U.S.C. §1001. Don’t turn a civil investigation into a criminal matter! Consult with an experienced, qualified health lawyer before making a statement to the government.

- Destruction, Alteration of Falsification of Records in a Federal Investigation. Upon learning of a state or a federal investigation, we recommend that you take steps to ensure that no evidence is destroyed, and no records are falsified. On the federal side, under 18 U.S.C. §1519:

“Whoever knowingly alters, destroys, mutilates, conceals, covers up, falsifies, or makes a false entry in any record, document, or tangible object with the intent to impede, obstruct, or influence the investigation or proper administration of any matter within the jurisdiction of any department or agency of the United States . . shall be fined under this title, imprisoned not more than 20 years, or both.”

VI. Conclusion: (Code H3)

In light of the pervasive and ongoing fraud and improper billing identified, Congress took steps to more easily document whether care was, in fact, being provided in a beneficiary’s home. Under the 21st Century Cures Act,[12] Electronic Visit Verification (EVV) was mandated for all Medicaid-funded personal care and home health services that require an in-home visit by a provider since January 1, 2020. Unfortunately, a number of states requested a temporary exemption and have not fully implemented an effective EVV program in their jurisdiction.

While the full implementation of EVV will undoubtedly improve personal care billing compliance, the fact remains that law enforcement is actively auditing these programs to ensure that any fraud, waste and abuse of these programs is eliminated. If you have been contacted in connection with a personal services audit, investigation and / or criminal prosecution, we can help. Our attorneys have extensive experience representing personal care service providers and attendants. Give us a call at (800) 475-1906 for a free consultation.

Liles Parker attorneys have had considerable experience and success in representing personal care agencies and attendants. Our team has a solid history of assisting personal care agencies and attendants in administrative, civil and criminal proceedings. Additionally, Liles Parker attorneys have significant experience in assisting providers in establishing and auditing effective compliance plans and programs. Anyone seeking further assistance in this area should contact Ashley Morgan at 800-475-1906.

- [1] https://www.cms.gov/medicare-medicaid-coordination/fraud-prevention/medicaid-integrity-program/education/personal-care-services

- [2] U.S. Government Accountability Office (GAO): “Improper Payments: Fiscal Year 2022 Estimates and Opportunities for Improvement.” GAO-23-106285 (March 2023).

- [3] HHS Office of Inspector General, “Medicaid Fraud Control Units: Fiscal Year 2022 Annual Report.” OEI-09-23-00190 (March 2023).

- [4] Of the $728 billion in total Medicaid spending in Fiscal Year 2021, states paid 31% and the federal government paid 69%. This estimate is based on an analysis of KFF.

- [5] A Fact Sheet on the CCC+ waiver program can be found at this link.

- [6] https://www.dmas.virginia.gov/for-members/managed-care-programs/ccc-plus/#:~:text=Commonwealth%20Coordinated%20Care%20Plus%20

(CCC,members%20with%20complex%20care%20needs. - [7] In contrast to the consumer-directed model, in a traditional model, agencies hire workers and deploy them into beneficiaries’ homes.

- [8] https://www.cms.gov/medicare-medicaid-coordination/fraud-prevention/medicaid-integrity-education/downloads/pcs-prevent-improperpayment-factsheet.pdf

- [9] OIG, “Personal Care Services – Tends, Vulnerabilities and Recommendations for Improvement.” OIG-12-12-01 (November 2012).

- [10] MFCU Fiscal Year 2022 Annual Report, Page 5.

- [11] To the extent that the OIG is involved, the agency could pursue the case administratively and seek Civil Monetary Penalties in response to wrongful conduct.

- [12] See Section 12006(a) of the 21st Century Cures Act.

You must be logged in to post a comment.