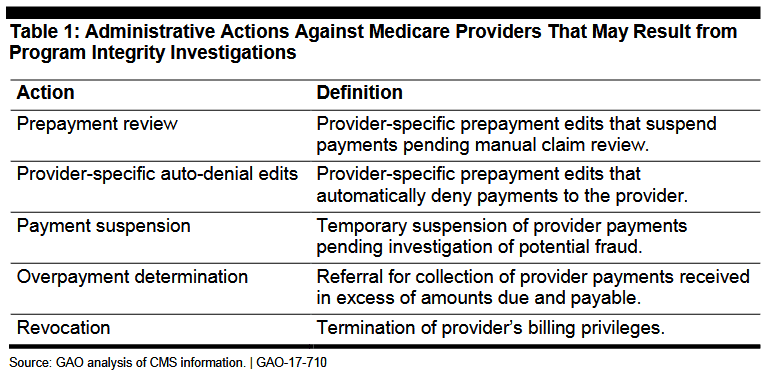

(December 14, 2017): The Centers for Medicare and Medicaid Services (CMS) has engaged various types of outside contracting entities to perform program integrity functions on behalf of the Medicare program. At the present time, Uniform Program Integrity Contractors (UPICs) and Zone Program Integrity Contractors (ZPICs) are very aggressive when it comes to referring evidence of potential fraud to federal law enforcement agencies, primarily the Department of Health and Human Services, Office of Inspector General (HHS-OIG) and the U.S. Department of Justice (DOJ). In matters where fraud is not apparent but it appears that other improper conduct has occurred, UPICs and ZPICs are actively recommending to CMS that adverse administrative actions (such as the revocation of your Medicare billing privileges), be taken. As the General Accounting Office (GAO) noted in its August 2017 report entitled “CMS Fraud Prevention System Uses Claims Analysis to Address Fraud,” the administrative actions[1] recommended by these program integrity contractors typically range from prepayment review to revocation.[2]

I. Background:

To participate in the Medicare program, a provider must typically complete either a CMS-855A, CMS-855B, CMS-855I or CMS-855S[3] enrollment application, each of which requires that the provider disclose their practice or office address.[4] Notably, a provider may also provide documentation of its “practice location” with its enrollment application.[5] Once a provider has enrolled in the Medicare program, any changes to the provider’s enrollment information must be reported within a strict timeframe. For example, a change in practice location must be reported within 30 days.[6]

Among their various duties, Medicare Administrative Contractors (MACs), UPICs and ZPICs are required to periodically perform site visits in order to verify that a provider is operational, that the provider’s enrollment information is accurate, and that the provider is in compliance with applicable Medicare enrollment requirements.[7] To accomplish this, the CMS contractor will normally inspect the “qualified physical practice location” given by the provider or supplier that is currently in file with the MAC. See, e.g., JIB Enterprises, LLC, DAB CR3010, at 9 (2013).

II. Failure to Meet Provider Requirement to Maintain Active Enrollment Status :

Over the past year, our firm has represented more physicians, home health agencies and other providers than ever before in challenging proposed Medicare revocation actions. As we indicated in an article on ZPIC audits last March, program integrity contractors are aggressively conducting site visits of enrolled providers. Approximately one-third of these revocation actions have been based on a Medicare contractor’s assertion that they were unable to verify a provider’s operational status. In many cases, this has occurred because a provider has moved its office or clinic without properly reporting the relocation to Medicare in a timely manner. GAO’s December 2017 report on the status of CMS fraud efforts illustrates how frequently this particular category of revocation action has been occurring. As GAO noted with respect to Florida:

“According to a 2016 report, from July 1, 2015, through September 30, 2016, a contractor covering Florida had conducted 9,891 site visits to verify providers’ and suppliers’ operational status, deactivated 422 practice locations, and revoked or denied 1,157 providers.”[8]

III. What Occurs if a Medicare Contractor Believes that a Provider is Not Operational?

What does it mean for a provider’s practice or office to be “operational”? As set out under 42 C.F.R. § 424.502, the term operational:

“means the provider or supplier has a qualified physical practice location, is open to the public for the purpose of providing health care related services, is prepared to submit valid Medicare claims, and is properly staffed, equipped, and stocked (as applicable, based on the type of facility or organization, provider or supplier specialty, or the services or items being rendered), to furnish these items or services.”

Therefore, if a UPIC or ZPIC were to visit the location of your practice (as then listed in Medicare’s records) and were to find that the practice or office were closed, the contractor would likely take the position that your organization is not operational.

Neither UPICs nor ZPICs exercise independent authority to issue a revocation letter or otherwise revoke your Medicare billing privileges. These contractors must first obtain prior approval from CMS’ Provider Enrollment & Oversight Group (PEOG). When seeking approval to initiate a revocation action, the contractor is required to cite the specific regulatory basis upon which this adverse action is being based. In most cases, obtaining CMS approval to initiate a revocation action is a perfunctory step in the process. Once approval is obtained, the provider’s Medicare billing privileges are normally revoked, retroactive to the date that the CMS contractor determined that the provider was not operational.[9] As set out in the Federal Register:

“Moreover, we maintain that when CMS or our contractor determines that a provider or supplier, including a DMEPOS supplier, is no longer operating at the practice location provided to Medicare on a paper or electronic Medicare enrollment application that the revocation should be effective with the date that CMS or our contractor determines that the provider or supplier is no longer operating at the practice location”.[10]

A. Non-Operational Due to Change in Location Without Proper Notice.

We have handled practically every permutation of this scenario that you can imagine. The most common facts have involved a provider or supplier who moved offices and failed to notify their MAC. As luck would have it, a UPIC or ZPIC contractor conducted a site visit, found that the practice location on file was closed or empty, and concluded that it was not operational. The contractor then recommended to CMS that a revocation action be pursued.

In several instances, the provider and / or the provider’s office manager was willing to swear that written notice of the change in location was, in fact, sent to the MAC. Unfortunately, unless the provider can provide proof that notice was given by Certified Mail, Return Receipt Requested or other trackable mail service, these cases have been an uphill battle in the administrative appeals process.

In other cases, a provider has been able to show that written notice was given, in a timely fashion, to state regulatory authorities. In at least one case, a provider argued that the MAC was provided proper notice through the Cost Report process. Unfortunately, proof of such notice was not provided to the Administrative Law Judge so no ruling as to adequacy was issued.

The bottom line with respect to notice is fairly straight forward, timely notice of a change in practice location must be provided to the MAC, on the proper form and within the proscribed time limits. Moreover, as with all communications to a CMS contractor, it is imperative that proof of submission and receipt be maintained.

B. Non-Operational Due to Closed or Non-Staffed at the Time of the Site Visit.

From a practical standpoint, a provider doesn’t necessarily have to change its practice or office location to be found non-operational. We have handled multiple cases where a ZPIC contractor conducted a site visit at the provider’s address listed on the CMS-855, but for one reason or another, the office was locked and was not staffed at the time of the visit, thereby giving rise to a revocation action.

IV. A Look at the Regulatory Bases for Revocation:

As reflected under 42 CFR §424.535(a)(1)-(14), there are fourteen regulatory bases for revocation that may be relied upon by the government. This article focuses on only one of these reasons for revocation – a provider’s failure to notify Medicare of a change in its practice location. Notably, there are several regulatory bases that may be cited when revoking a provider’s billing privileges for this infraction, each of which are briefly discussed below.

A. 42 C.F.R. §424.535(a)(1), “Non-Compliance.”

Under 42 C.F.R. §424.535(a)(1), a revocation may be pursued if:

“The provider or supplier is determined to not be in compliance with the enrollment requirements described in this subpart P or in the enrollment application applicable for its provider or supplier type, and has not submitted a plan of corrective action as outlined in part 488 of this chapter. The provider or supplier may also be determined not to be in compliance if it has failed to pay any user fees as assessed under part 488 of this chapter.

- CMS may request additional documentation from the provider or supplier to determine compliance if adverse information is received or otherwise found concerning the provider or supplier.

- Requested additional documentation must be submitted within 60 calendar days of request.”

Under this basis for revocation, CMS or one of its contractors typically alleges that a provider has violated an enrollment requirement listed on the enrollment application or currently in Medicare’s electronic records system. Although most revocation actions pursued under this regulatory provision are based on a licensure-related violation, the scope of the provision is broad enough to cover situations where a provider has failed to meet its obligations to report a change in practice location in a timely fashion.

B. 42 C.F.R. §424.535(a)(5), “On-Site Review.”

Under 42 C.F.R. §424.535(a)(5), a revocation action may be pursued if:

“Upon on-site review or other reliable evidence, CMS determines that the provider or supplier is either of the following:

- No longer operational to furnish Medicare-covered items or services.

- Otherwise fails to satisfy any Medicare enrollment requirement.”

As previously indicated, both CMS contractors are actively conducting site-visits of Medicare providers and suppliers in an efforts to better ensure the program integrity of the Medicare Trust Fund. These site-visits are expected to intensify, not subside in 2018. It is therefore essential that you understand your obligations under the regulations to qualify as an “operational” entity and to properly notify Medicare of any changes to your enrollment status.

C. 42 C.F.R. §424.535(a)(9), “Failure to Report.”

Under 42 C.F.R. §424.535(a)(9) a revocation action may be pursued if:

“The provider or supplier did not comply with the reporting requirements specified in § 424.516(d)(1)(ii) and (iii) of this subpart".

As 42 C.F.R. §516(d)(1)(ii) and (iii) describes, physicians, nonphysician practitioners, and their organizations must report any adverse legal action or change in practice location to their Medicare contractor within 30 days. If a provider that has failed to meet this reporting requirement is subject to having their Medicare billing privileges revoked under 42 C.F.R. §424.535(a)(9).

V. Impact of a Medicare Revocation Action:

Simply put, if your Medicare billing privileges are revoked, you will be barred from participating in the Medicare program from the date of the revocation until the end of the re-enrollment bar that has been identified in the revocation letter. The re-enrollment bar lasts from 1 – 3 years. [11] The length of the re-enrollment bar depends on the severity of the reason for the underlying revocation. The re-enrollment period begins 30 days after the provider receives the notice of revocation letter from CMS.

Under 15.1.1 of the MPIM, the definition of the term “Final Adverse Action” includes a “Medicare-imposed revocation of any Medicare billing privileges”. More than likely, each of your private payor participating agreements includes a requirement that you notify the payor within 30 days of any adverse action. If for some reason your particular contract does not include this requirement, it is important to remember that all licensing boards, payors and hospitals have access to the NPDB and regularly submit queries on their staff or licensees. Depending on the reason for revocation, these organization may choose to pursue a reciprocal action.

VI. Appealing a Medicare Revocation Action:

As reflected in Section IV above, the business impact of a revocation action on your practice can be devastating. If you are facing a revocation action, we strongly recommend that you engage experienced health law counsel to represent you in the process. Unlike the traditional Medicare administrative appeals process, the Medicare revocation appeals process has abbreviated timeframes and is highly restrictive with respect to the introduction of evidence and arguments. Having said that, our attorneys have been very successful in working directly with CMS to resolve many of these revocation actions to the satisfaction of our clients and achieve a result that likely would be unavailable through the traditional revocation appeals process.

Generally, the Medicare revocation appeals process is set out under 42 C.F.R. § 405.803, "Appeal Rights". As this provision outlines, a provider is entitled to challenge the revocation of its Medicare billing privileges an may appeal an initial determination made by CMS or its contractor by following the procedures specified in Chapter 498. A brief overview of these provisions is outlined below:

Preliminary Appeal Determination: Can We File a Corrective Action Plan (CAP)?

In limited circumstances, if a provider’s Medicare billing number has been revoked, it may be afforded an opportunity by CMS to take remedial action to correct the deficiencies that were the basis for the revocation action. After the effectuation of the December 2014 Final Rule, only provider’s whose Medicare billing privileges have been revoked due to non-compliance under 42 CFR 424.535(a)(1) are entitled to submit a CAP. The other thirteen regulatory bases for revocation are not eligible for CAP remediation. To the extent that your revocation action falls within category, the CAP must be submitted within 30 days of the date of the revocation notice and must provide evidence that the provider is now in full compliance with its applicable obligations. If the provider can demonstrate compliance, CMS will reinstate the provider’s billing privileges. If the CAP is denied, the provider can still exercise its appeal rights under Part 498. Importantly, the submission of a CAP does not “stay” your appeal deadlines. More than likely, you will therefore pursue a dual-track approach is challenging the revocation action.

Appeal Level I: Reconsideration.

The first level of appeal for a provider to contest the evocation of its Medicare billing privileges is known as the “Reconsideration” level. A reconsideration request must be submitted within 60 days from receipt of the notice of initial determination. Take care, some appeals will be filed with the CMS-PEOG while others must be filed with MAC. Any documentary evidence a provider wants considered by the hearing officer assigned to their case must be submitted at this level of appeal. If a provider later wants to submit documentary evidence into the record, an Administrative Law Judge (ALJ) will require that the provider show “Good Cause” exists for the late submission of the evidence. "Good Cause" is rarely found to exist absent evidence of an Act of God that prevented earlier submission.

Appeal Level II: Administrative Law Judge (ALJ) Hearing.

Should you not prevail at the reconsideration level of appeal, you can seek a hearing before an ALJ of the HHS Departmental Appeals Board, Civil Remedies Division. Requests for an ALJ hearing must be submitted within 60 days from the date of the reconsideration decision. The ALJ hearing is like a "mini-trial". The government will be represented by an attorney assigned by your HHS Regional Office of General Counsel. If the facts in the case are contested, both sides will typically submit briefs, introduce evidence and present witness and / or expert testimony. If both sides agree as to the basic facts in the case, the ALJ will often issue his / her ruling based on the written record.

Appeal Level III: Departmental Appeals Board (DAB) Hearing.

Both the provider and CMS may contest a decision of the ALJ. Should a party choose to do so, they must request review of the ALJ’s decision by the Departmental Appeals Board, Appellate Division within 60 days of the date of the ALJ’s decision. Importantly, this is the end of the proverbial line administratively. If a provider is dissatisfied with the DAB’s ruling, it must seek judicial review.

Appeal Level IV: Judicial Review.

If a provider wishes to challenge the decision of the DAB, it must file a civil action in U.S. District Court within 60 days of the date of the DAB decision. If a provider can show “Good Cause,” the DAB is permitted to extend the civil action filing deadline.

VII. Conclusion:

The revocation of a provider’s Medicare billing number often comes as a shock. It is never expected and few providers are prepared to effectively respond to the challenges presented by the hyper-strict requirements of the revocation appeals process. It is important to keep in mind that the appeals process isn’t meant to provide a level playing field for a provider to argue its case. Unfortunately, the rules are skewed in favor of CMS from the very start. It is therefore essential that you take steps to challenge the revocation of your Medicare billing privileges. Unless you are skilled in responding to these types of adverse actions, it is likely in your best interests to engaged experienced health law counsel.

Robert W. Liles, J.D., M.B.A., M.S., is a former Federal prosecutor and an experienced health lawyer. Robert and the other lawyers at Liles Parker, PLLC, represent health care providers and suppliers around the country in connection with Medicare revocation actions. If you or your practice have been had their Medicare billing privileges revoked, please give Robert a call for a complimentary consultation: Please call: 1 (800) 475-1906.

- [1] Importantly, this list of administrative adverse actions is not all-inclusive. For instance, as set out in Section 4.19.2.2 of the Medicare Program Integrity Manual (MPIM), UPICs and ZPICs are also required to review and evaluate cases to determine if they warrant exclusion action. If so, they are to make a recommendation to OIG for exclusion. One of the examples cases suitable for exclusion listed in the MPIM includes:

“Providers who are the subject of prepayment review for an extended period of time (longer than 6 months) who have not corrected their pattern of practice after receiving educational/warning letters.” - [2] As defined under 15.1.1 of the MPIM, the term “Revocation” means that the provider or supplier’s billing privileges are terminated.

- [3] CMS-855A - Medicare Enrollment Application for Institutional Providers; CMS-855B - Medicare Enrollment Application for Clinics, Group Practices, and Certain Other Suppliers; CMS-855I - Medicare Enrollment Application for Physicians and Non-Physician Practitioners; CMS-855S - for DME suppliers.

- [4] 42 C.F.R. § 424.510(a).

- [5] 42 C.F.R. § 424.510(d)(2)(ii).

- [6] See 42 C.F.R. § 424.516(d)(1)(iii).

- [7] 42 C.F.R. §§ 424.510(d)(8), 424.515(c), 424.517(a).

- [8] GAO-18-88. “CMS Needs to Fully Align Its Antifraud Efforts with the Fraud Risk Framework,” December 2017. See footnote 62.

- [9] 42 C.F.R. §§ 405.800(b)(2); 424.535(a)(5)(i), (g).

- [10] 73 Fed. Reg. 69,725, 69,865 (Nov. 18, 2008) (emphasis added).

- [11] 42 CFR §424.535(c)

- [12] If a revocation actions is based on an “Abuse of Billing Privileges” under 42 CFR 424.535(a)(8), the initial level of appeal (Reconsideration) will be filed directly with CMS rather than with the provider’s MAC.