(September 30, 2019): On September 5, 2019, the Department of Health & Human Services (HHS), Office of Inspector General (OIG) published an HHS-OIG Data Brief entitled “The Centers for Medicare & Medicaid Services Could Use Comprehensive Error Rate Testing Data To Identify High-Risk Home Health Agencies”[1] The purpose of OIG’s review was two-fold: First, OIG examined the results of “high-risk” home health claims reviews conducted by Comprehensive Error Rate Testing (CERT) contractors during the Fiscal Years (FY) 2014 through 2017 and identified the most common types of errors that resulted in claims denials. Second, OIG wanted to identify factors that can be used to more readily identify high-risk home health agencies, reduce improper payments and ultimately reduce the home health CERT error rate. The purpose of this article is to examine the common types of home health claims errors identified by CERT contractors and discuss steps that your agency should take when responding to a CERT audit request.

I. Overview of the CERT Audit Program:

In 1996, the OIG first measured the improper payment rate for traditional Medicare, Fee-for-Service (FFS) claims on a nationwide basis. The OIG continued to estimate the Medicare FFS improper error rate until 2002. In 2003, the Centers for Medicare & Medicaid Services (CMS) took over responsibility for handling these measurements. To do so, CMS implemented the Comprehensive Error Rate Testing (CERT) program.

The CERT program was designed to measure improper payments made under the Medicare FFS program and comply with the Improper Payments Information Act (IPIA).[2]

What is considered to be an improper claim? CERT contractors are specifically tasked with the review of a sample of Part A and Part B claims that have been paid by a Medicare Administrative Contractor (MAC) or a Durable Medical Equipment (DME) MAC.

After pulling a sample of paid Medicare FFS claims, the CERT contractor will then contact the responsible health care provider or supplier and request a copy of the medical documentation associated with the claim at issue. Upon receipt, the CERT contractor will then audit the claim to determine whether it was correctly paid by the responsible MAC or DME MAC. If the MAC or DME MAC should have denied a claim or paid the claim at a different amount, the claim is considered to be an improper payment. Each year, CERT contractors review approximately 50,000 Medicare FFS claims. Based on their findings, a national improper payment rate is calculated.

II. CERT Audits of Home Health Medicare Claims:

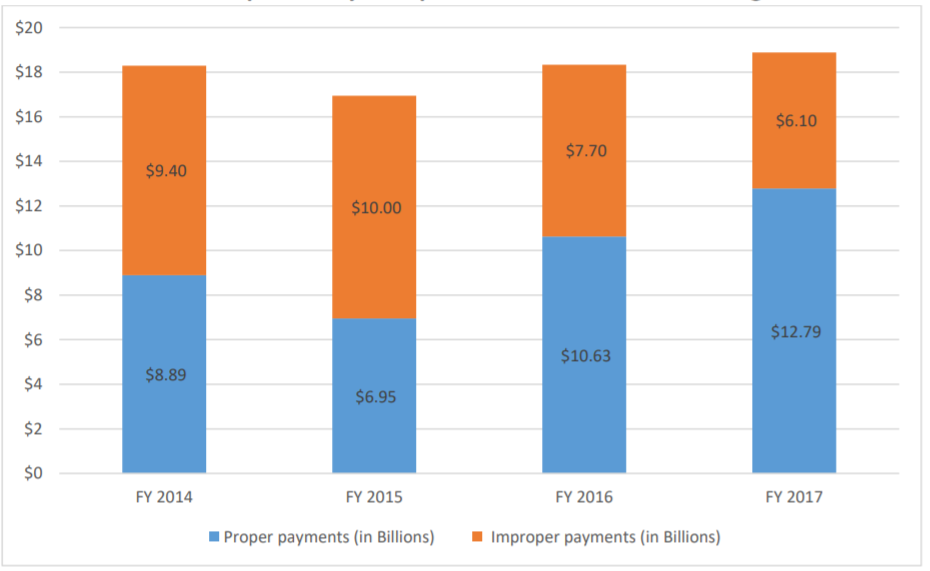

During the period FY 2014 through FY 2017, CERT auditors found that improper payment rates of Medicare FFS claims paid to home health agencies has significantly decreased, from 51% error rate in FY 2014 to 32% error rate in FY 2017.

Estimates of Improper Home Health Agency Payments as Reported by Comprehensive Error Rate Testing

III. The OIG Analysis of CERT Home Health Error Data:

Despite the fact that significant progress by home health agencies has been made, CERT auditors calculated that as of FY 2017, approximately 32% of the Medicare FFS payments made to home health agencies were improper. This error rate is more than three times higher than the overall national improper payment rate of 9.51%.[3]

With the CERT contractor’s findings in mind, the OIG conducted an analysis of the CERT audit results in an effort to identify “high-risk HHAs with high rates of improper payments as well as the common types of errors that caused improperly paid claims.” [4]

As the OIG report notes, there is no definitive list of high-risk HHAs. Therefore, the OIG assembled a list of home health agencies that have had three or more improperly paid claims (as identified by CERT auditors) during the period FY 2014 through FY 2017.

IV. What Were the OIG’s Findings with Respect to High-Risk Home Health Agencies?

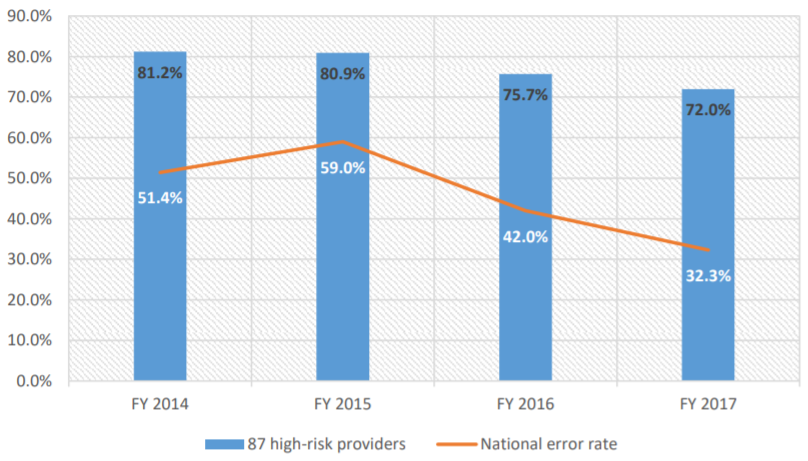

Upon review of the CERT audit findings, the OIG estimated that from FY 2014 through FY 2017, more than $4 billion was paid to high-risk home health agencies. More significantly, OIG estimates that during this same period, 78% of the CERT-reviewed payments made to high-risk home health agencies were improper. As the chart below reflects, from FY 2014 to FY 2017, the improper error rate of high-risk home health agencies declined from a high of 81.2% to a low of 72.0%. Nevertheless, it is important to remember that the error rate for high-risk home health agencies remains more than twice the overall error rate for all home health agencies.

The 87 High-Risk Home Health Agencies’ Error Rate Compared With the Home Health Agency National Error Rate

V. Primary Claims Errors of High-Risk Home Health Agencies:

Overall, OIG found that more than 90% of the CERT audit denials of high-risk home health agencies were based on “insufficient documentation.”The primary documentation errors noted included the following:

49% of Face-to-Face Evaluations Did Not Meet Medicare Documentation Guidelines.

As Palmetto GBA (the MAC for Texas-based home health agencies) has noted, the most common face-to-face documentation deficiencies identified by CERT auditors included the fact that (1) the documentation was insufficient to show that the physician-patient encounter was related to the primary reason for home care, (2) the documentation was insufficient to show how the patient’s condition supports the patient’s homebound status, and / or (3) the documentation was insufficient to show how a patient’s condition supports the need for skilled services.

16% of Physician Certification and Recertification Requirements Have Not be Properly Documented.

Under 42 CFR 424.22(a)(1), a physician must certify that a patient is eligible for Medicare home health services. The contents of a proper certification must reflect that (1) the individual needs or needed intermittent skilled nursing care or physical therapy or speech-language pathology services, (2) the individual is confined to the home except when receiving outpatient services, (3) a plan for furnishing services has been established and will be or was periodically reviewed by an eligible physician, (4) a face-to-face patient encounter, related to the primary reason the patient requires home health services, occurred no more than 90 days prior to the home health start of care or within 30 days of the start of care. Additionally, the face-to-face encounter must be conducted by a physician, nurse practitioner, certified nurse specialist, certified nurse midwife or a physician assistant (as described in 42 CFR 424.22(a)(1)(v)(A) through (B)).

Additional documentation errors included:

- 9% of Orders were improperly documented or were missing.

- 9% of Outcome and Assessment Information was not in the OASIS repository or the patient’s medical records.

- 5% of Plans of Care were not properly documented or were missing.

- 4% of Progress Notes were not fully documented to support a billed date of service by specific specialists or were missing.

- 8% Other documentation deficiencies.

VI. Comments from CMS:

Although CMS acknowledged that home health claims remain problematic, the agency took issue with the OIG’s findings. As the agency wrote:

“CMS does not believe this methodology for identifying error-prone HHAs is valid. The CERT program calculates the improper payment rate for the entire Medicare Fee-for-Service program by evaluating a statistically valid stratified random sample of claims to determine if they were paid properly under Medicare coverage, coding, and billing rules. . . However, the service-type improper payment rates do not have similar precision requirements and therefore CERT data is not precise at the provider level.” (emphasis added).

Regardless of whether you side with the OIG or with CMS, there is no dispute that overall, home health agency documentation remains incomplete and / or missing 32.2% of the time. Unfortunately, home health agencies in Ohio, Illinois, Texas, North Carolina and Florida (Review Choice Demonstration Project states), are especially vulnerable as the project ramps up in these states.

VII. Recommendations for Home Health Agencies:

Home health agencies around the country remain under the microscope. Agency claims are being subjected to Target, Probe & Educate (TPE) audits, Additional Documentation Requests (ADRs), Prepayment Review and Postpayment Audit. Implementation of the Review Choice Demonstration Project in the five states above further adds to the significant audit risks already faced by home health agencies in these states.

Now, more than ever before, it is imperative that home health agencies conduct periodic internal reviews of their documentation practices to ensure that they are meeting the myriad requirements that have been established by CMS in order for home health claims to qualify for coverage and payment. Moreover, it is important to keep in mind that there are multiple government contractors that may audit your home health agency at any time. The following chart provides an overview of the current home health audit landscape.

As a participating provider in the Medicare program, a home health agency is required to have an effective Compliance Program in place. One of the seven elements of your Compliance Program includes “Monitoring, Auditing and Internal Reporting Systems.” If you have not already done so, your home health agency needs to periodically conduct internal audits and reviews to better ensure that physicians, nurse practitioners, therapists and staff are properly documenting their services in a compliant fashion.

- [1] Department of Health & Human Services, Office of the Inspector General, HHS OIG Data Brief, A-05-17-00035, entitled “The Centers for Medicare & Medicaid Services Could Use Comprehensive Error Rate Testing Data to Identify High-Risk Home Health Agencies.” (August 2019).

- [2] The IPIA was later amended by the Improper Payments Elimination and Recovery Act (IPERA) of 2010 and the Improper Payments Elimination and Recovery Improvement Act (IPERIA) of 2012.

- [3] See https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/CERT/

- [4] Data Brief: Analysis of Home Health CERT Data (A-05-17-00035). Page 3.