Author: Christin Thompson, Annabella Denzel

(October 10, 2023): In terms of revenues and expenses, health care providers and suppliers have repeatedly faced two unfortunate realities: (1) Reimbursement rates are shrinking, and (2) they are constantly being saddled with additional unfunded mandates (for example, HIPAA compliance, OSHA requirements, compliance obligations, etc. Coupled with ordinary practice expenses, many health care providers are finding it increasingly difficult to remain profitable.[1] Regardless of whether billing is conducted in-house or is sent out to a third-party billing company, the fees and expenses associated with these services can be significant. Unfortunately, Medicare, Medicaid and private payor audits and investigations are increasingly denying claims based on alleged coding errors, billing mistakes, lack of medical necessity and a provider’s failure to properly document the services rendered.

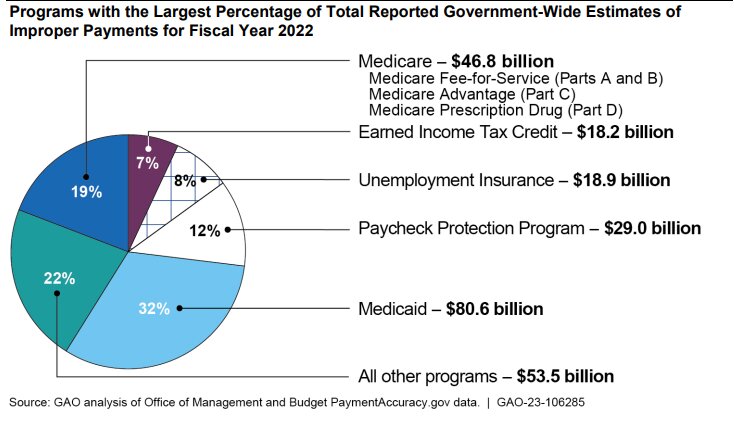

In Fiscal Year (FY) 2022 alone, the U.S. Government Accountability Office (GAO) has estimated that $46.8 billion was improperly paid in connection with Medicare Fee for Service (FFS), Medicare Advantage (Part C) and Medicare Prescription Drug (Part D) claims. During FY 2022, the Centers for Medicare and Medicare Services (CMS) has estimated the Medicare Part B improper payment rate as 8.41%. while the improper payment rate for Durable Medical Equipment (DME) suppliers was estimated to be 25.24%.[2] Additionally, the Medicaid program improperly paid $80.6 billion in improper claims during FY 2022.[3] Notably, these estimates don’t even take into account the sizeable improper billings submitted to private payors. Collectively, these coding errors and billing mistakes are costing government and private payors a fortune. To combat these improper claims practices, payors are increasingly relying on electronic edits, prepayment reviews and postpayment audits to ferret out overpayments and instances of fraud.[4] Ultimately, these error rates must decrease if smaller practices hope to remain profitable. Is artificial intelligence (AI) part of the answer? As AI becomes more widely utilized across a widely divergent set of industries, a number of experts have argued that AI in medical billing may be around the corner. “Anything image or text-centric is a great opportunity for AI,” Dr. Eric Wilke explains. “So, yes, pathology, radiology, and dermatology are all areas of opportunity, but so is analyzing charts for billing and coding.” [5] In this article, we will outline a number of possible benefits when it comes to using AI in medical billing, health care compliance, cost reduction, and time management. We will also assess several of the potential negative consequences of adopting AI into the medical billing process.

I. AI Utilization: Autonomous or Automated?

Before jumping into the pros and cons of AI, we must understand what a practical use of the tool would look like in a health care billing setting. AI could be used to implement both autonomous and automated coding practices. To be clear, these solutions aren’t something to look forward to in the future. They are already here.

- Autonomous AI. Autonomous medical coding entails setting up an AI program with all relevant data and language so that it may bill and code entirely independent of human interaction. Of course, a coder would be able to review the submissions, but only after their creation. After being implemented in a large East Coast medical center, one autonomous medical coding platform has reportedly resulted in a 58.7% reduction in denials, reduced charge processing time, and significant annual cost savings.[6]

- Automated AI. Automated coding would use its data set to suggest relevant codes to a human being for billing claims. In that scenario, the AI is utilized similar to how an accountant uses QuickBooks. Rather than setting up the AI and substituting its use for human coders, this method of implementation allows coders to review billing suggestions and accept or deny based on their own understanding of the case in question. While this could be considered the safest implementation of AI in coding billing, the specific benefits and potential disadvantages of AI should be noted prior to practice integration.

II. The Benefits of Incorporating AI into Medical Billing, Coding, Compliance and Operations:

The integration of AI into medical billing, coding, compliance and operations has the potential to revolutionize the health care industry by making each of these processes more accurate, efficient, and cost-effective. Here are some of the key benefits of leveraging AI in these health care administrative areas:

- Increased Accuracy. AI systems can be trained to identify and correct errors in coding and billing, ensuring that claims are coded correctly the first time. This can help reduce claim denials due to coding errors.

- Efficiency and Speed. AI systems and processes can scan and code medical records at a pace much faster than human coders, reducing the turnaround time for billing. A case study of the Nividous AI coding program showed drastic cuts in time spent creating and submitting procedure claims—AI helped work through cases 85% faster than without the program.[7] This is logical. For less complex cases where there is a history of data points, AI can fill a claim form in milliseconds compared to a person doing so manually. For more intricate cases, there may be more time needed, however, having suggestable coding preemptively available still significantly decreases time spent.

- Cost Savings. With improved accuracy and efficiency, health care providers and suppliers can expect to see a reduction in denied claims, which can result in significant cost savings. Furthermore, reducing the hours spent on billing and coding can benefit practices by diminishing the burden of administrative costs, especially for smaller practices. This can lead to more financial security and additional opportunities, like reallocation of those funds to other necessary endeavors. Additionally, lower error rates directly correlate with lower rates of payment denials. AI’s radical reduction of errors may help providers avoid the hassle of the claims appeal process in some cases. With less claim denials comes less time spent trying to recover funds. Finally, lower error rates may even remove providers from potential audit activities, resulting in even more time and money saved. While some practice types are considered high-risk for compliance at all times, those who have previously struggled with high billing error rates may find that AI’s error rate reduction removes the provider from audit targets.

- Quickly Implement Changes. AI systems can be updated quickly with the latest coding standards, ensuring compliance with the ever-changing medical billing rules and regulations.

- Rapid Identification of Fraud and Improper Practices. Providers and suppliers can utilize AI to detect unusual billing patterns or anomalies that might suggest fraudulent activity, helping to prevent health care fraud. In the Nividous case study cited above, coding accuracy was estimated to have increased by a whopping 90%.[8] From our review of the literature, no alternative method of coding has resulted in such a drastic decrease in errors up to this point in medical billing. Because of AI’s ability to store case information and build up a comprehensive systemic understanding of common cases and their corresponding codes, errors like typos or accidental upcoding are significantly less likely to occur. With lower error rates come greater rates of compliance and lower rates of payment denials.

- Consistency. AI provides consistent coding and billing decisions, eliminating the variability that might be introduced by different human coders and billers.

- Data Analysis. With the capability to process vast amounts of data, AI can provide insights into billing trends, payment patterns, and other useful metrics that can help healthcare providers optimize their billing processes.

- Scalability. AI-powered systems can easily scale to handle larger volumes of data, making them suitable for both small practices and large healthcare systems.

- Continuous Learning. As AI systems process more data, they can learn and improve over time. This ensures that the system remains up-to-date and continues to improve in accuracy and efficiency.

- Integration with a Variety of Electronic Health Records (EHRs). AI can be integrated seamlessly with EHR systems to pull relevant information for coding, reducing the need for manual data entry.

- Patient Engagement. Theoretically, if a provider is able to improve the automation of backend administrative and technical processes, a practice’s medical staff can focus more on patient care.

- Less Payor Oversight. If a provider or supplier is able to show payors that its coding and billing practices are both transparent and accurate, it can increase a payor’s level of trust and possibly reduce the need and frequency of payor audits.

- AI Systems Can be Custom Tailored. AI systems can be tailored to address the specific needs of medical specialties and practices, thereby ensuring that coding and billing recommendations are relevant to the specific health care setting at issue.

While AI offers numerous benefits in medical coding and billing, it's essential that physician practices, coders and billers approach its implementation with care. Proper training data, regular system checks, and human oversight are crucial to ensure that the AI system functions optimally, ethically and within the four corners of applicable regulatory and statutory requirements.

III.Risks of Utilizing AI in Medical Billing, Coding and Compliance:

Are the perks of AI for billing and coding too good to be true? Potentially. Of course, switching to an autonomous or automated AI billing process is not as simple as its proponents may claim. For an AI system to effectively process data, it will require a significant amount of historical data and oversight to reach the level of accuracy needed before a provider or third-party billing company can rely on its accuracy. Make no mistake – AI is here to stay. The real question for providers, suppliers and ancillary health care companies is whether now the time for a health care organization to make the jump into this fast-moving environment. Several possible risks to consider include:

- Without Near Perfect Historical Data, the Error Rate May Not Change. Otherwise known in the tech world as the “garbage in, garbage out” phenomenon, AI is only as good as the information with which it starts working.[9] Without near perfect historical data, it is incredibly easy to confuse the AI program into making some serious mistakes. This means that if the person setting up the program is not almost entirely accurate and comprehensive in their initial data entries, the AI will either create its own outputs which can lead to error, or it will follow the incorrect data to incorrect conclusions. This is no small consideration, as it can actually negate any and all benefits of AI utilization, especially if the billers and coders reviewing the program’s outputs are not sufficiently educated or experienced to recognize the errors.[10] For smaller practices, whose billers often have multiple administrative duties, this is even more dangerous. Saving time is only helpful if it is also decreasing the mistakes made. Thus, if a provider chooses to incorporate AI into their billing efforts, they should consider involving both an expert in AI programming and a medical coding expert in the AI training process.

- Medical Billing Regulations are Always Changing. Further, billing regulations constantly evolve, which means that AI programs’ data schema will require near constant updates.[11] Mathematically speaking, the more a program is modified, the more likely errors in the data will occur, which cycles back to the issue described above. Practices using AI will likely have to retain an AI programmer to ensure mistakes in new data entry are not occurring.

- Patient Privacy May be at Risk. With any data entry system there are risks to the privacy of the information once it is entered into a program. There are ethical and legal ramifications especially when AI is used in handling medical records containing protected health information. The Brookings Institute’s statement on this topic says it all:

“As artificial intelligence evolves, it magnifies the ability to use personal information in ways that can intrude on privacy interests by raising analysis of personal information to new levels of power and speed.” [12]

AI needs historical data to build a schema which may create future decisions; this means that accurate and likely real, personal patient data is the best to input for billing and coding programs. While there are currently no explicit regulations or guidelines regarding HIPAA and AI, they are coming. The GAO has published an assessment of AI in the diagnosis process,[13] and billing and coding will likely follow. Depending on the level of a provider‘s culpability, a HIPAA violation can result in monetary penalties ranging from $100 to $50,000 per violation.[14] Clearly, such violations can be devastating, especially when they are likely to occur in multiples.[15] Therefore, it is in a providers’ best interests to err on the side of caution when dealing with private health information and AI inputs.

- Compliance Issue: How do You Audit a Machine? Just like with every shift in the field, AI will come with compliance considerations and its own regulations and guidelines. Though not clearly laid out at this point, as AI becomes more prevalent in the industry, the government and payors will eventually learn how to distinguish error rates of AI programs, and auditing will inevitably follow. The problem is that providers do not currently have a method of AI compliance review, meaning proactively correcting compliance issues caused by AI may not be easily identified or remediated. Only time will tell how prevalent AI use will become, but caution is advised to any provider who throws their proverbial hat in the AI ring so early in its introduction to healthcare. Providers should have legal counsel with compliance experience available to ensure that when regulations are finalized, compliance can be accomplished as swiftly and comprehensively as possible.

IV. Conclusion:

The coding and billing of health care services and supplies is a complex process, subject to ever-changing contractual obligations and regulatory changes. Health care compliance has become so complex that it practically requires a law degree to properly assess the risk environment and to advise a provider on options for addressing an identified problem. If conservatively used, and applied with a skeptical eye, providers and suppliers will likely identify a healthy balance of AI and human support. There are real benefits regarding AI in coding and billing, but the implementation of AI gives may give rise to a whole new set of enforcement risks. Regardless of whether your practice incorporates AI into your processes or continues to handle its coding and billing functions manually, experts in compliance, coding and billing will remain vital to ensure that the AI “cure” will not result in merely new types of improper coding and billing practices. Questions? Please feel free to give us a call if you would like to discuss medical necessity, documentation, coding, billing or health care compliance issues facing your organization. We can be reached at: 1 (800) 475-1906.

Liles Parker attorneys have extensive experience representing health care providers and suppliers around the country in connection with Federal, State and private payor claim audits and investigations. Notably, many of our health lawyers are also Certified Professional Coders (CPCs) and / or Certified Medical Reimbursement Specialists (CMRSs). If you need assistance, Give Christin Thompson a call. For a free consultation, we can be reached at: 1 (800) 475-1906.

- [1] A study published in the Journal of the American Medical Association found that 25-31% of healthcare providers’ expenses arise from administrative costs, particularly billing and insurance claims. Tseng P, Kaplan RS, Richman BD, Shah MA, Schulman KA. “Administrative Costs Associated With Physician Billing and Insurance-Related Activities at an Academic Health Care System.” JAMA. 2018;319(7):691–697.

- [2] Post COVID-19, CMS has resumed its use of “Comprehensive Error Rate Testing (CERT)” program calculate these improper payment rates.

- [3] U.S. Government Accountability Office (GAO): “Improper Payments: Fiscal Year 2022 Estimates and Opportunities for Improvement.” GAO-23-106285 (March 2023).

- [4] Len Strazewski, Payor audits on the rise. How private practices can get ready. American Medical Association (Apr. 11, 2022), https://www.ama-assn.org/practice-management/private-practices/payor-audits-rise-how-private-practices-can-get-ready. See also Jacqueline LaPointe, Hospital Claim Denials Steadily Rising, Increasing 23% in 2020, Revcycle Intelligence (Feb. 4, 2021), https://revcycleintelligence.com/news/hospital-claim-denials-steadily-rising-increasing-23-in-2020.

- [5] Jacqueline LaPointe, Medical Coding is the Next Stop for Artificial Intelligence in Healthcare, Revcycle Intelligence (Oct. 03, 2022), https://revcycleintelligence.com/features/medical-coding-is-the-next-stop-for-artificial-intelligence-in-healthcare.

- [6] See the recent case study published by CODAMETRIX.

- [7] Himani Soni, Artificial Intelligence in Medical Billing: An Introduction, Nividous (Jul. 8, 2022), https://nividous.com/blogs/artificial-intelligence-medical-billing.

- [8] Id.

- [9] Altay Ataman, Data Quality in AI: Challenges, Importance & Best Practices, AI Multiple (Apr. 7, 2023) https://research.aimultiple.com/data-quality-ai/.

- [10] Supra, note (iv).

- [11] AI in Medical Coding. Okay. Let’s Talk., Contempo Coding Podcast (May 19, 2023), https://www.youtube.com/live/5_N5tzcJYbk?feature=share.

- [12] Cameron F. Kerry, Protecting privacy in an AI-driven world, Brookings Institute (Feb. 10, 2020), https://www.brookings.edu/articles/protecting-privacy-in-an-ai-driven-world/.

- [13] Artificial Intelligence in Health Care: Benefits and Challenges of Machine Learning Technologies for Medical Diagnostics, U.S. Gov. Accountability Office (Sept. 2022), https://www.gao.gov/assets/gao-22-104629.pdf.

- [14] What are the Penalties for a HIPAA violation?, The HIPAA Journal, https://www.hipaajournal.com/what-are-the-penalties-for-hipaa-violations-7096/#penaltiesfornoncompliancewithhipaa.

- [15] Id.