(October 3, 2022): Aquatic therapy is a common method of rehabilitation and maintenance for several types of injuries and conditions, and the practice is widely accepted by Medicare, Medicaid and many private payors. Historically, both payors and law enforcement have routinely audited aquatic therapy claims. The Centers for Medicare and Medicaid Services (CMS) initially suspended most audit activity as a result of the Public Health Emergency (PHE). In August 2020, CMS lifted the hold on administrative audits and both Unified Program Integrity Contractors (UPICs) and Medicare Administrative Contractors (MACs) have resumed their medical review audits and investigations of aquatic therapy claims billed to Medicare. In this article, we will examine a number of the practices that have led to administrative sanctions, civil liability and / or criminal charges. We will also discuss a number of the steps that you can take to reduce your organization’s level of regulatory and enforcement risk.

I. Medicare Coverage of Aquatic Therapy Services and CPT Code 97113 Claims:

A. Appropriate Use of Aquatic Therapy.

Generally, aquatic therapy (also known as hydrotherapy) is a form of physical therapy in which the patient enters a pool and performs small, controlled exercise movements to rehabilitate or maintain pain levels for various ailments.[1] Medicaid, Medicare, and private payors will typically cover these services when the treatment is medically necessary, complies with the payor’s billing requirements, and is properly coded.

B. General Medical Necessity Requirements.

Section 1862(a)(1)(A) of the Social Security Act states that “No Medicare payment shall be made for expenses incurred for items or services which… are not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member.” [2] In the case of aquatic therapy, treatment is deemed medically necessary for patients whose condition requires that their therapy be less strenuous than regular physical therapy. Rehabilitation for serious injuries or maintenance therapy for chronic musculoskeletal conditions are instances in which aquatic therapy will often be approved and performed. Not surprisingly, different payors have different positions regarding what constitutes medical necessity for aquatic therapy.

C. Aquatic Therapy Billing Practices.

Aquatic therapy services are billed under CPT Code 97113. In laymen’s terms, this code covers a provider’s instruction and supervision of a patient’s “Therapeutic procedure, 1 or more areas, each 15 minutes; aquatic therapy with therapeutic exercises.”[3] Billing providers are also required to bill aquatic therapy services by “time.” More specifically, aquatic therapy is billed by the number of units (15-minute increments) performed. MACs have identified a number of coverage limitations on the billing of CPT Code 97113. For example:

D. Medicare Administrative Contractor (MAC) Medical Necessity Requirements.

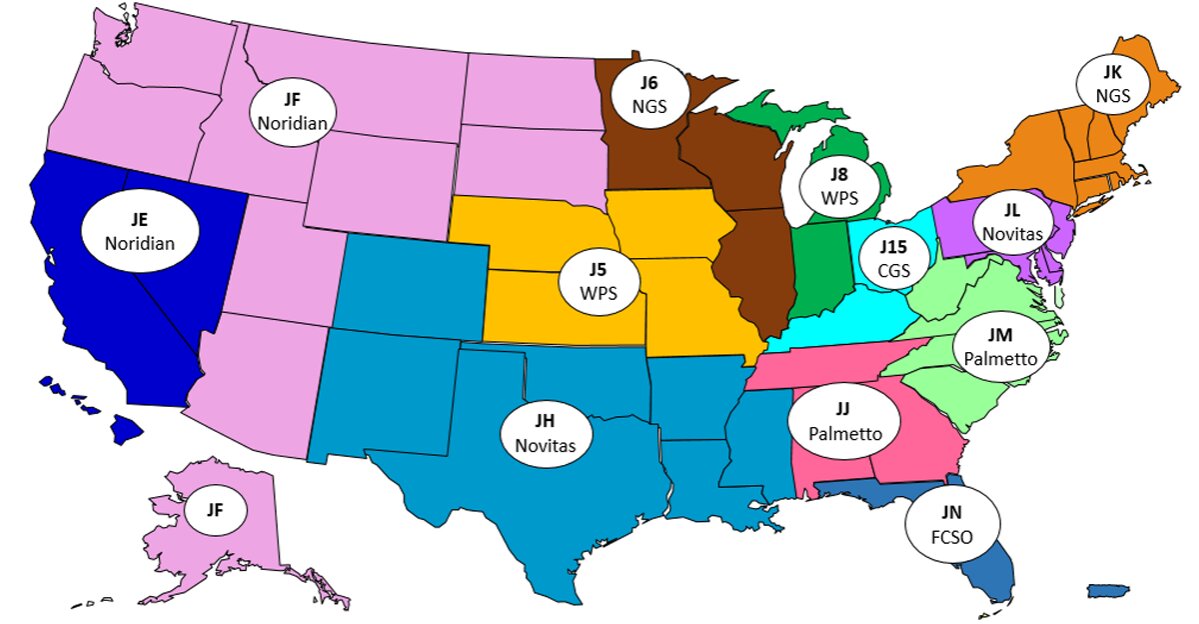

As an examination of the medical necessity and billing requirements established by the different Medicare contractors will reflect, it is little wonder that many providers have expressed confusion and frustration regarding their obligations to document a patient’s need for aquatic therapy and properly bill for the services. Currently, the following MACs are responsible for processing Medicare Part B claims around the country:

We have reviewed the aquatic therapy medical necessity and billing requirements of a number of these MACs. Our findings are set out below.[4] Please keep in mind that these requirements are subject to change. We recommend that you review the CMS listing of LCDs to verify if the medical necessity and billing requirements have been revised since the publication of this article.

First Coast Service Options, Inc. (FCSO).

First Coast Services Options, Inc. (First Coast) has issued Local Coverage Determination (LCD) L33413,[5] which provides that with respect to medical necessity:

Aquatic therapy with therapeutic exercise may be considered medically necessary if at least one of the following conditions is present and documented:

- the patient has rheumatoid arthritis;

- the patient has had a cast removed and requiring mobilization of limbs;

- the patient has paraparesis or hemiparesis;

- the patient has had a recent amputation;

- the patient is recovering from a paralytic condition;

- the patient requires limb mobilization after a head trauma; or

- the patient is unable to tolerate exercise for rehabilitation under gravity based weight bearing.

Please note, FCSO has issued specific coding guidelines which provide that aquatic therapy (CPT Code 97113) “should not be billed in situations where no exercise is being performed in the water environment (e.g. debridement of ulcers).” Nor should it be billed where there is not one-on-one contact between the patient and his or her therapist.[6] Further, the provider cannot bill for any time in which the patient is engaging in previously taught exercises or not actively engaging with the patient’s movements.

Novitas Solutions (Novitas).

Novitas Solutions, Inc. (Novitas) notes in LCD L35036[7] that aquatic therapy may be considered medically reasonable and necessary when:

• the patient cannot perform land-based exercises effectively to treat their condition without first undergoing the aquatic therapy, or

• aquatic therapy facilitates progression to land-based exercise or increased function. Documentation must be available in the record to support medical necessity.

It is not medically reasonable and necessary to employ hydrotherapy and aquatic therapy during the same treatment session.

Unlike other MACs, Novitas has elected not to issue substantive guidance in its Local Coverage Article, Article A57703.[8] Instead, Article A57703 refers providers back to LCD L35036, the contractor’s LCD covering aquatic therapy services.

CGS Administrators, LLC (CGS).

CGS’s LCD L34049ix provides guidance regarding the provision and coverage of aquatic services. In addition to generally citing Section 1862(a)(1)(A) of the Social Security Act, LCD L34049 further states that aquatic services:

. . . may be reasonable and necessary for the loss or restriction of joint motion, strength, mobility, balance or function due to pain, injury, or illness by using the buoyancy and resistance properties of water. Aquatic therapy may be considered reasonable and necessary for a patient without the ability to tolerate land-based exercises for rehabilitation. Aquatic therapy exercises should be used to facilitate progression to land based therapy. The qualified professional/personnel auxiliary personnel does not need to be in the water with the patient unless there is an identified safety issue.

Exercises in the water environment to promote overall fitness, flexibility, improved endurance, aerobic conditioning, or for weight reduction are non-covered.

CGS’s billing and coding guidelines on aquatic therapy services are set out in Article A57067. As this guidance reflects, no more than 4 units of CPT Code 97113 may be billed per day, per discipline.[10]

National Government Services, Inc. (NGS).

NGS’s LCD L33631[11] provides general guidance regarding the medical necessity of outpatient therapy.[12] As LCD L33631 provides, in order for outpatient therapy to be considered reasonable and necessary, it must meet Medicare guidelines and a patient’s condition must have the potential to improve within “a reasonable and generally predictable period of time.”[13] In addition to these basic medical necessity requirements, the aquatic services to be provided:

. . . may be reasonable and necessary for the loss or restriction of joint motion, strength, mobility, balance or function due to pain, injury, or illness by using the buoyancy and resistance properties of water.

Aquatic therapy may be considered reasonable and necessary for a patient without the ability to tolerate land-based exercises for rehabilitation. Aquatic therapy exercises should be used to facilitate progression to land based therapy and to increased function. The qualified professional/auxiliary personnel does not need to be in the water with the patient unless there is an identified safety issue.

The aquatic therapy billing guidance issued by NGS is perhaps the most detailed of any MAC. As NGS has noted in Article A56566:

The aquatic therapy treatment minutes counted toward the total timed code treatment minutes should only include actual skilled exercise time that required direct one-on-one patient contact by the qualified professional/auxiliary personnel. Do not include minutes for the patient to dress/undress, get into and out of the pool, etc. (Emphasis added).[14]

Because of this time factor, documentation is crucial to the billing process. Detailed, quantitative descriptions of the therapy process are key for proper billing and may prevent later allegations of improper billing or fraud. As NGS’s article on the billing and coding of outpatient physical and occupational therapy services further provides, “documentation must support the use of each procedure as it relates to a specific therapeutic goal.”[15] Additionally, NGS Article A56566 provides that there must be clear documentation to support medical need for aquatic therapy to continue after 8 visits. Maintaining thorough documentation of therapy goals, exercises attempted and their efficacy, and patient progress from the onset of treatment will benefit providers during the billing process to ensure accuracy in units of the code and reimbursement after that 8-visit limitation. As a final point, NGS requires that at least every 10 visits, supportive documentation for CPT Code 97113 must include:

- Justification for use of a water environment

- Objective loss of ADLs, mobility, ROM, strength, balance, coordination, posture and effect on function

- If used for pain include pain rating, location of pain, effect of pain on function

- Specific exercises/activities performed (including progression of the activity), purpose of exercises as related to function, instructions given, and / or assistance needed to perform exercises to demonstrate that the skills and of a therapist were required.

E. Private Payors.

While Medicare generally covers aquatic therapy for chronic illnesses such as rheumatoid arthritis, not all payors allow aquatic therapy to be utilized for maintenance programs and chronic ailments. For example, Aetna Health’s policies limit medical necessity to only sessions of aquatic therapy which will lead to progressive rehabilitation and restoration of function after injury or illness.[16]

II. What are the Risks You and Your Practice May Face When Improperly Billing for Aquatic Therapy Services and CPT Code 97113 Claims?

A. Administrative Sanctions and Penalties.

Over the years, most of the aquatic therapy services audits we have handled have been the result of Medicare, Medicaid and private payors audits that have been triggered through data mining and claims analysis. In the past, CMS program integrity contractors (such as UPICs) regularly found that a provider’s documentation for aquatic therapy services was lacking and did not meet the contractor’s medical necessity requirements. Since the resumption of CMS contractor audits, many aquatic therapy providers have been receiving Additional Documentation Requests (ADRs) from their MAC. Your physical therapy practice may also have its aquatic therapy claims placed on prepayment review or subjected to a postpayment audit by a UPIC.

B. UPIC Administrative Audits Can Result in Civil and / or Criminal Referrals.

While MACs and other CMS contractors are continuing to audit physical therapy and aquatic therapy claims, your physical therapy practice may receive a document request from a UPIC. As you will recall, UPICs are a special breed of CMS contractor – their primary goal is to "[I]nvestigate instances of suspected fraud, waste, and abuse in Medicare or Medicaid claims."[17] Don’t turn an administrative audit into a criminal prosecution! To the extent that your claims are audited, it is essential that you don’t engage in improper or illegal conduct that may exacerbate the seriousness of your case. For example, in the case discussed below, when faced with an administrative audit, the owner of physical therapy practice improperly altered patient records.

• Connecticut. This case demonstrates how the defendant’s improper conduct resulted in an administrative audit being referred to the U.S. Attorney’s Office for criminal prosecution. It also illustrates the government’s practice of pursuing "parallel prosecutions" where both criminal charges were brought AND civil violations of the False Claims Act were alleged. Here, the owner of a physical therapy practice received notice that his practice’s claims were going to be audited by a CMS contractor. The owner allegedly instructed one of his employees to lie to the Federal contractor in an effort to delay the audit. The owner then took steps to alter patient records and added progress notes (even though no progress notes were created at the time of service). The government alleged that the notes made it appear that Medicare beneficiaries had received one-on-one services from a licensed physical therapist when, in fact, some of the services were provided by unlicensed, auxiliary personnel. The government criminally prosecuted the owner of the practice for obstruction. The defendant waived his right to indictment and pleaded guilty to one count of “Obstructing a Federal Audit." He was sentenced to three years of probation. In addition to the criminal charges, the government also alleged that the practice violated the civil False Claims Act. The practice paid $328,828 to resolve the False Claims Act allegations presented.

C. Civil Sanctions – False Claims Act Liability.

In recent years, there have been a number of False Claims Act cases brought against physicians, their practices and related entities for the failure to meet one or more of the requirements needed to properly bill incident to. For example:

• Colorado. A recent False Claims Act settlement was announced by the U.S. Attorney’s Office for the District of Colorado. In this case, a “whistleblower” filed a lawsuit under seal against a physical therapy practice alleging that the practice was billing the Medicare program for aquatic therapy services that were not medically necessary or were not provided. The owner of the practice subsequently admitted that the practice had billed the Medicare and Medicaid programs for individual aquatic therapy services when, in fact, the patients had participated in group aquatic therapy sessions. During the investigation, the government learned that the defendant had falsely billed TRICARE patients for physical therapy by an authorized provider when the services were actually performed by a non-authorized provider. To resolve the case, the defendant practice and its owner agreed to pay $400,000 to satisfy the government’s False Claims Act allegations.

D. Criminal Prosecution for Aquatic Therapy Fraud and Related Conduct.

Federal agents and investigators are actively investigating allegations of physical therapy fraud (in general) and aquatic therapy fraud (in particular).

• Pennsylvania. In a recent case that remains ongoing, Federal prosecutors have indicted 20 individuals on charges of “Conspiracy to Commit Wire and Health Care Fraud,” and “Health Care Fraud.” The indictment also names the Pennsylvania-based physical therapy practice as a corporate defendant. It is worth noting that this large, complex case investigated through the coordinated efforts of (1) The Federal Bureau of Investigation (FBI), (2) The Department of Health and Human Services, Office of Inspector General (HHS-OIG), (3) The Department of Veteran’s Affairs, Office of Inspector General (VA-OIG), (4) The Office of Personnel Management, Office of Inspector General (OPM-OIG), (5) The Defense Criminal Investigative Service (DCIS), and (6) The Pennsylvania Office of Attorney General, Medicaid Fraud Control and Abuse Unit (MFCU). The improper conduct alleged the government includes, but is not limited to the following allegations:

- Billing for unlicensed technicians. The physical therapy practice is accused of utilizing unlicensed technicians to provide physical therapy treatment, including aquatic treatment. However, the government alleges that the services were billed as if they were performed by a licensed physical therapist or physical therapy assistant.

- Improper use of the practice’s therapy documentation system. Unlicensed technicians logged into the practice’s documentation system as a licensed therapist. The government alleges that this practice made it seem like the services were performed by a licensed therapist.

- Billing for excess time. The government claims that the practices and its licensed therapists regularly recorded and billed for treatment time in amounts that were in excess to the actual time spent treating patients.

- Failure to code therapy some sessions as group therapy. The government alleges that therapy sessions were rarely billed as “group therapy” even though that was how the services should have been coded and billed.

- Billing under the name of a physical therapist that was not present. The government alleges that the practice billed for services using the name of a physical therapist who was on vacation and not working on the date at issue.

- Fraudulently altering the treatment record. The government alleged that some insurance payors only covered services performed by a physical therapist. It is alleged that the practice permitted physical therapy assistants and unlicensed personnel to provide treatment. The practice and its employees supposedly then removed the names of the non-qualified staffer who provided treatment.

- Fraudulently altering the treatment schedule. The government alleged that the practice and its employees manually changed the patient schedule to conceal the fact that Medicare patients were scheduled at the same time as other patients and were treated one-on-one by a physical therapist.

III. Ways to Reduce Your Level of Risk When Billing for Aquatic Therapy Services:

The administrative, civil and criminal enforcement actions discussed above were all preventable to the extent that any of the transgressions were an error, accident or mistake. In that case, an effective Compliance Plan should have identified these deficiencies. Corrective steps to repay any overpayment and implement steps to prevent the error from reoccurring could then be made. To the extent that the improper conduct was knowingly and willfully performed, it is imperative that providers recognize that they will eventually be caught. As the criminal case above reflects, a total of six separate law enforcement agencies were involved in the identification and prosecution of these Pennsylvania defendants. Between payor Special Investigation Units (SIUs), government enforcement agencies, competitors, disgruntled employees and observant patients, the odds are stacked against provider bad actors.

Your Compliance Plan should take into account each of the common and practice-specific risk areas that have been identified with aquatic therapy. Steps you can take to reduce your level of regulatory and enforcement risk include, but are not limited to the following:

A. Implement an Effective Compliance Program.

If you have not already done so, we recommend that you develop, implement and follow an effective Compliance Program. As a participating provider in the Medicare and / or Medicaid programs, you are required to have such a program in place.[18]

B. Ensure that All Treating Providers are Properly Licensed.

Unfortunately, we have seen a number of instances over the years where a physical therapist or other health care professional has had their license suspended or revoked. An adverse licensure action may be the result of failure to pay annual fees to the State Board of Physical Therapy or the failure to complete and submit mandatory Continuing Medical Education (CME) hours in a timely fashion. Alternatively, it may be the result of a disciplinary action taken against the licensee. In any event, professional physical therapy services cannot be performed and billed by an unlicensed staff member. Should you find that this has unknowingly occurred, you must perform a review of all impacted claims and return any overpayments that are identified. Billing for the services performed by an unlicensed physical therapist under the name and NPI of a licensed physical therapist may result in severe administrative sanctions (Medicare suspension and / or revocation), the imposition of civil penalties and damages, and / or criminal prosecution for health care fraud.

C. Have Your Payor’s Specific Requirements for Medical Necessity Been Met?

Unfortunately, the term “medical necessity” has been defined differently from payor to payor. Some payors have conflated “medical necessity” with “coverage.” In other words, they have taken the position that certain care and treatment modalities are not medically necessary if a patient suffers from a specific condition or diagnosis. What they are really saying is that their plan does not cover the treatment of that condition. In any event, it is important that you research how each specific payor defines medical necessity and whether their plan covers the proposed care and treatment to be performed.

D. Is All of the Information Billed Truthful and Accurate?

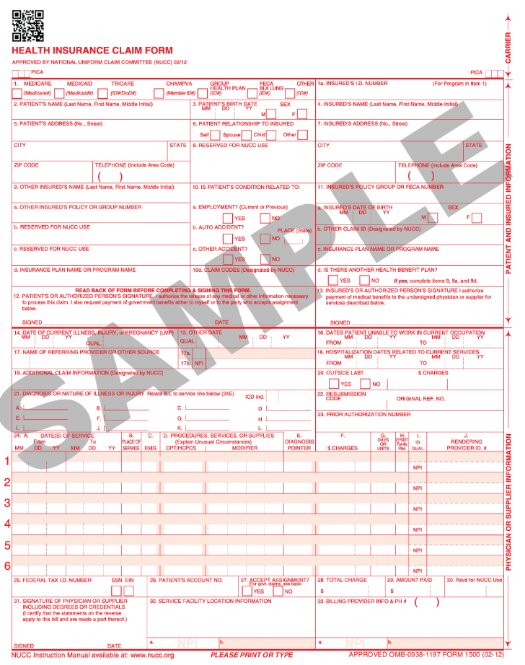

Today, practically all claims are submitted electronically. Nevertheless, the information submitted still includes the data elements contained in a CMP Form 1500. As part of your regular compliance duties, you should be periodically auditing and monitoring your claims. This process is not limited to a review of the medical documentation and a comparison with the LCD’s documentation requirements. It should also include a review of the specific data elements coded and billed in connection with the claim being audited.

To properly audit a claim, you need to pull the electronic information submitted which essentially corresponds to the information reflected in the CMS Form 1500. Check each element carefully and ensure that it is correct. For example:

- Is the date of the service when the care was provided?

- Is the number of therapy units billed for CPT Code 97113 accurate?

- Is the provider of the services the actual physical therapist who performed the care?

- Were the physical therapy services performed in connection with the billing of CPT Code 97113, associated with one-on-one therapy OR was the patient actually participating in a group therapy session?

- Assuming that the physical therapy services were medically necessary, properly coded and accurately billed, was the amount of reimbursement received from the payor accurate? We have seen numerous cases where mistakes were made in either the EMR processing or at the clearinghouse level. In a recent False Claims Act case we handled, the government took the position that the provider had an obligation to ensure that the ultimate amount of reimbursement received was accurate.

E. Exercise Caution When Billing Services “Incident To.”

Incident to billing was first permitted (in limited situations) 45 years ago. Since first permitted, the practice has gradually been expanded to its current form.[19] Medicare does not permit the services provided by Physical Therapist Assistant (PTAs) to be billed “Incident To” the professional services of a physician or non-physician practitioner (e.g. Nurse Practitioner (NP) or Physician Assistant (PA)), because PTAs do not meet the qualifications of a therapist. Only the services of a qualified, licensed Physical Therapist can be billed “Incident To” those of a supervising physician. Moreover, all applicable requirements to bill “Incident To” must also be met.

F. Group Therapy Services Cannot be Billed Under CPT Code 97113.

Billing for aquatic therapy should always be under CPT code 97113, which requires one-on-one interaction between patient and provider. Billing for services in which a group of patients is treated simultaneously will never be valid for reimbursement.

G. Don’t Turn an Administrative Problem Into a Civil or Criminal Case.

The UPIC audit example discussed above illustrates how a provider may take actions that can lead to the referral of the matter to the Department of Justice for further review and enforcement. Falsifying records, obstructing an audit and lying to investigators are three quick ways to exacerbate an audit that it is otherwise administrative in nature and turn it into a criminal investigation.

H. Although Aquatic Therapy is Helpful Does Not Mean that it Qualifies for Coverage.

A prescribing physician may determine that aquatic therapy would be helpful to treat a wide variety of conditions that have not been recognized as a covered condition by one or more payors. For example, there is evidence that aquatic therapy has been beneficial in the care and treatment of patients with asthma[20], autism[21] and lymphedema. Unfortunately, just because an ordering physician may find that aquatic therapy is medically necessary to treat one of these conditions, does not mean that it will qualify for coverage and payment. Many payors have expressly stated that the use of aquatic therapy to treat one or more of these conditions is considered experimental or investigational. As such, it does not qualify for coverage.

Are your physical therapy or aquatic therapy claims currently being audited by the government? If so, we recommend that you engage experienced legal counsel to represent you. Liles Parker attorneys have extensive experience and expertise representing practices in audits of physical therapy and aquatic therapy claims. Many of our health law attorneys are also Certified Professional Coders (CPCs) and / or Certified Medical Reimbursement Specialists (CMRSs). Questions? Give us a call for a free consultation. We can be reached at: 1 (800) 475-1906.

- [1] A definition of Hydrotherapy / Aquatherapy can be found on the website of Physiopedia.

- [2] Medicare B Guideline Index. The Posture Works. (2008, February).

- [3] American Medical Association (AMA) definition of CPT Code 97113.

- [4] We have not reviewed the aquatic therapy requirements for Noridian Healthcare Solutions (Noridian) and Wisconsin Physician Services (WPS).

- [5] Centers for Medicare & Medicaid Services (CMS) (First Coast Service Options, Inc.(FCSO)), Local Coverage Determination (LCD) L33413: “Therapy and Rehabilitation Services.” (Revision Effective Date: For services performed on or after October 1, 2019).

- [6] FCSO Coding Guidelines, ATHERSVCS.

- [7] CMS (Novitas) LCD L35036, “Therapy and Rehabilitation Services (PT, OT).” (Revision Effective Date: For services performed on or after March 9, 2022).

- [8] Novitas Article A57703, “Billing and Coding: Outpatient Physical and Occupational Therapy Services.” (Revision Effective Date, January 1, 2020).

- [9] CMS (CGS Administrators, LLC. (CGS)) LCD L34049: “Outpatient Physical and Occupational Therapy Services.” (Revision Effective Date: For services performed on or after June 2, 2022).

- [10] CGS Article A57067, “Billing and Coding: Outpatient Physical and Occupational Therapy Services.” (Revision Effective Date, June 2, 2022).

- [11] CMS (National Government Services, INC. (NGS)) LCD L33631: “Outpatient Physical and Occupational Therapy Services.” (Revision Effective Date: For services performed on or after January 1, 2020).

- [12] NGS Article A56566: NGS has issued a separate article titled “Billing and Coding: Outpatient Physical and Occupational Therapy Services.” (Revision Effective Date” August 1, 2022).

- [13] See CMS Publication 100-02, Medicare Benefit Policy Manual, Chapter 15, Section 220.2(C).

- [14] NGS Article A56566.

- [15] NGS Article A56566.

- [16] Pool therapy, aquatic therapy or hydrotherapy. Aetna Health. (2022, April 15). https://www.aetna.com/cpb/medical/data/100_199/0174.html.

- [17] See Noridian Healthcare Solutions’s (Noridian’s) discussion of UPICs.

- [18] See our article titled “Mandatory Compliance Programs for Medicare and Medicaid Providers?”

- [19] For additional information regarding “Incident To” billing (albeit in the context of NPs and Physician Assistants, NOT Physical Therapists), see our article titled “Incident To Billing Practices are Under Law Enforcement’s Microscope. Are Your Incident To Billing Practices Compliant?”

- [20] See PubMed Central Article “Asthma, exercise-induced asthma, and aquatic physical activities.” Journal of Back and Musculoskeletal Rehabilitation. 1994 Jan 1;4(4):309-14. doi: 10.3233/BMR-1994-4410.

- [21] See PubMed Central article “Effects of Aquatic Therapy for Children with Autism Spectrum Disorder on Social Competence and Quality of Life: A Mixed Methods Study.” International Journal of Environmental Research and Public Health. 2021 Mar; 18(6): 3126.