CMS UPDATE – DECEMBER 24, 2025

“Effective immediately, CMS’ A/B Medicare Administrative Contractors (MACs) are withdrawing the Local Coverage Determinations (LCDs) for Skin Substitute Grafts/Cellular and Tissue-Based Products for the Treatment of Diabetic Foot Ulcers and Venous Leg Ulcers that were scheduled to become effective on January 1, 2026.”

ORIGINAL ARTICLE

(December 11, 2025): In 1789, when commenting on the newly established U.S. Constitution, Benjamin Franklin famously wrote to French scientist Jean-Baptiste Le Roy that “In this World, Nothing Can be Said to be Certain, Except for Death and Taxes.” [1] In view of the last thirty years of persistent, repeated Medicare audits and investigations, we have no doubt that if Benjamin Franklin were here today, he would have added “Wound Care and Skin Substitute Audits” to his list of life’s certainties. We have regularly commented on the importance of health care provider self-audits and internal reviews to help ensure that wound care and skin substitute products are properly documented, meet applicable coverage requirements, are medically necessary, are properly coded, and have been correctly billed.[2] The failure to perform these compliance assessments can result in significant administrative overpayments. Depending on the facts, in more serious improper wound care audits / skin substitute audits, the government may seek multiple damages and civil penalties under the False Claims Act. If the government alleges violations of the Anti-Kickback Statute, a health care provider may face criminal prosecution. In 2026, health care providers should expect a new wave of Medicare skin substitute audits and investigations. In this article, we examine recent concerns regarding wound care / skin substitute billing raised by law enforcement and its agents. We also discuss steps health care providers can take to reduce their level of regulatory risk.

I. Background -- Medicare Coverage and Payment for Wound Care and Skin Substitutes:

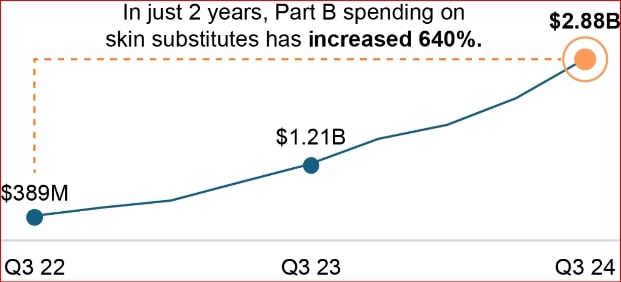

As the largest single payer for health care in the United States, the Medicare program faces a number of ongoing challenges in ensuring the integrity of its payments for wound care supplies, services, and skin substitute products. Over the past three years, explosive growth in spending, coupled with mounting evidence of fraud, waste, and abuse, has prompted a new wave of skin substitute audits, investigations, and enforcement actions. In fact, the Department of Health and Human Services (HHS), Centers for Medicare and Medicaid Services (CMS) recently commented on the explosive growth of Medicare Part B expenditures for wound care products, citing a variety of abusive practices that have contributed to this problem.[3]

II. Escalating Expenditures Have Led to Increased Scrutiny by CMS Contractors and Law Enforcement:

Medicare Part B expenditures for skin substitutes have increased from $256 million in 2019 to over $10 billion annually by late 2024. This represents an increase of approximately 640% in just two years.[4] This unprecedented growth in spending has made wound care services and skin substitute product claims a target of CMS program integrity contractors and law enforcement agencies. As described below, multiple organizations are actively conducting skin substitute audits of claims billed to Medicare and other Federal health benefit programs.

A. Rise of the “Fraud Defense Operations Center” (FDOC).

In March 2025, CMS launched a new pilot program, the Fraud Defense Operations Center (FDOC). By May 2025, the FDOC had identified and stopped payment on more than $100 million in fraudulent Medicare claims. In recognition of its early success, CMS made the program permanent in June 2025. Notably, the FDOC uses artificial intelligence to conduct data-driven analyses and proactively detect and prevent fraud. Regarding wound care products, the FDOC has already identified and stopped multiple cases of improper billing for skin substitute products. Two examples include the following:

- $16 Million Billed in Connection with a Single Patient. The FDOC found that a dermatologist billed the Medicare program more than $16 million worth of skin substitute products in the treatment of a single beneficiary who had no supporting medical history.

- Fake Clinic with No Office, Providers or Patients Billed $1.4 Million to Medicare. When investigating the skin substitute billings of a Florida “clinic,” the FDOC found that the imaginary clinic had no office, no health care providers, and no patients. The FDOC further found that the operators were using stolen beneficiary data to file false claims with Medicare for skin substitute products. The FDOC immediately suspended payments and blocked 90% of the improper payments.

In less than eight months (March through November 2025), the FDOC has reportedly suspended more than $160 million in payments to suspect health care providers billing the Medicare program for skin substitute products.

B. CMS Contractor Audits.

Medicare Administrative Contractor (MAC) Audits. Medicare Administrative Contractors (MAC) are the operational “backbone” of the Medicare program. They are responsible for performing a wide range of important Medicare provider enrollment, claims processing, and billing compliance functions on behalf of CMS. In the context of wound care / skin substitute audits, there are two areas of current significance that should be considered:

- Local Coverage Determination (LCD) Guidance. CMS has not issued National Coverage Determination (NCD) guidance covering skin substitute grafts and tissue–based products. MACs are responsible for the development and drafting of Local Coverage Determinations (LCDs) for their specific geographic jurisdictions. Prior wound care LCDs issued by the MACs have primarily focused on:

- The application of skin substitute grafts for the treatment of Diabetic Foot Ulcers (DFUs) and Venous Leg Ulcers (VLUs), and

- Wound debridement procedures.

A number of the MACs have issued LCDs on the application and coverage of skin substitute grafts,[5] some of which have been retired or were never fully implemented. The skin substitute graft LCDs issued by a number of the MACs have been very similar. These MACs (and others) will be adopting updated LCD guidance covering skin substitute grafts for the treatment of DFUs and VLUs, CMS has delayed the effective date of this guidance until January 1, 2026, so that additional peer-reviewed evidence could be considered prior to finalization.

- Targeted, Probe and Educate (TPE) Skin Substitute Audits. Over the last two years, literally all of the MACs have actively initiated TPE audits of wound care related services and skin substitute products.[6] First Coast, Palmetto GBA (Palmetto), and Novitas Solutions (Novitas), have all been active in TPE wound care / skin substitute audits.

To its credit, First Coast has posted a checklist[7] on its website to assist wound care providers in responding to TPE audits and / or Additional Documentation Requests (ADR) asking for copies of documentation to support a skin substitute claim that has been submitted to the MAC for payment. A few months ago, First Coast also posted the initial results of its TPE skin substitute audits. Its findings are outlined below:

- Targeted, Probe and Educate (TPE) Results: Skin Substitute Graft for Treatment of DFU and VLU Lower Extremities (CPT Codes 15271 – 15278). After analyzing the initial results of TPE audits examining the use of skin substitute grafts to treat DFU and VLUs in a patient’s lower extremities, the MAC found that the primary reasons claims were denied included:

- Medical Necessity – The documentation submitted to the MAC by the wound care provider did not support medical necessity (as listed in LCD A57680), and

- Insufficient Documentation – The documentation submitted by the wound care provider was insufficient to support the skin substitute services billed to Medicare. According to First Coast, the documentation submitted

- Lacked the key elements to support the level of service billed,

- Did not support the anatomical area treated, or

- Was incomplete / insufficient.

First Coast has also developed and shared a checklist[8] on its website to be used by wound care providers when responding to TPE and / or ADRs seeking copies of documentation to support wound debridement claims.

- Targeted, Probe and Educate (TPE) Results: Wound Debridement (CPT Codes 11102-11103, 11200-11201, 11300-11303. 11305-11313 and 11401-11406, 11421-11424, 11426, 11440-11446). After analyzing the initial results of TPE audits examining wound debridement claims, the MAC found that the primary reasons wound debridement claims were denied included:

- Medical Necessity. The documentation submitted to First Coast did not support medical necessity as listed in the coverage requirements of LCD L37166; and

- Insufficient Documentation. The documentation provided by the provider was insufficient to support the wound debridement services as billed to Medicare. According to First Coast, the documentation submitted included one or more of the following deficiencies:

- The documentation lacked a valid plan of care, description of the wounds and / or did not properly document treatment effectiveness;

- The medical records lacked a documented method of debridement;

- The medical records were not legible;

- The documentation did not support the service billed;

- The documentation did not support the billed number of units;

- The documentation did not support “Incident To” billing[9]; and / or

- The documentation submitted was non-responsive to the contractor’s request.

It is important to note that TPE wound debridement audits are still listed as “Active” on First Coast’s website.[10] Moreover, based on the error rates identified by First Coast thus far, wound care providers should expect these audits to continue.

- Targeted, Probe and Educate (TPE) Results: Skin Substitute Graft for Treatment of DFU and VLU Lower Extremities (CPT Codes 15271 – 15278). After analyzing the initial results of TPE audits examining the use of skin substitute grafts to treat DFU and VLUs in a patient’s lower extremities, the MAC found that the primary reasons claims were denied included:

Supplemental Medical Review Contractor (SMRC) Audits. Noridian Healthcare Solutions LLC (Noridian) has been awarded the nationwide contract by CMS to serve as Medicare’s Supplemental Medical Review Contractor (SMRC). Noridian is actively auditing wound care surgical supplies.[11] Prior wound care-related projects have also included audits of Mohs surgical procedures.[12] Skin substitute products can be used in Mohs surgery, particularly for larger or more complex wounds where a traditional skin graft or flap may not be immediately possible. As such, they have been “fair game” for SMRC review when evaluating Mohs surgical claims.

Recovery Audit Contractor (RAC) Audits. Recovery Audit Contractors (RACs) are a component of CMS's overall strategy to ensure program integrity by identifying and correcting improper payments, both overpayments and underpayments, in the Medicare and Medicaid programs.[13] As you will recall, RAC audits can take two forms: (1) Automated, and (2) Complex.[14] Not surprisingly, most RAC audits of skin substitute claims have been “automated” in nature, focusing on facially evident errors that can be identified without a review of the patient’s medical records for the date of service at issue. In the case of skin substitute claims, RAC auditors have examined: (1) Whether the CPT codes billed are consistent with an appropriate ICD-10 diagnosis code; (2) Whether the quantity billed exceeds the number permitted under the LCD; (3) Whether the correct “Place of Service” (POS) code was billed. The appropriate POS code is crucial because Medicare's payment methodology and coverage rules vary significantly by setting. In terms of potential liability, RAC audit findings are almost always limited to identifying an overpayment. It is rare for RACs to refer a matter to the OIG or the U.S. Department of Justice (DOJ) for criminal prosecution.

Unified Program Integrity Contractor (UPIC) Audits. At the outset, it is essential that wound care providers recognize that Unified Program Integrity Contractors (UPICs) are a different breed of CMS contractor. Unlike Comprehensive Error Rate Testing (CERT) contractors, which are often involved in the identification of administrative overpayments, UPICs are program integrity contractors. Their primary function is the identification of fraud, waste, and abuse in the Medicare and Medicaid programs. As described in the Medicare Program Integrity Manual:

“The focus of the UPICs, SMRCs and MACs shall be to ensure compliance with Medicare regulations, refer suspected fraud and abuse to our Law Enforcement (LE) partners, and / or recommend revocation of providers that are non-compliant with Medicare regulation and policies.”[15] (Emphasis added).

In light of their mandate, wound care providers contacted by UPICs should exercise caution when responding to an audit. As our clients have seen, UPICs have increasingly targeted wound care claims, particularly those involving expensive skin substitutes billed under Medicare Part B. Typically, our clients have received an initial notice of audit, and a request for documents associated with 30-60 skin substitute claims that have been submitted by the provider. These document requests have been quite comprehensive. Specific documents sought by the UPIC always request copies of the patient's medical records associated with the specific claim at issue and any prior wound treatment records. UPIC document requests also ask for copies of the practice’s purchasing records, order forms, invoices, and rebates associated with the purchase of skin substitute products over the past year.

Upon review of a provider’s records, UPICs have often cited a number of common reasons for denial. For illustrative purposes, we have referenced the specific requirements of CGS Administrator’s LCD L36690, “Wound Application of Cellular and/or Tissue Based Products (CTPs), Lower Extremities.” [16]Typical denial reasons cited by UPICs include:

- Lack of Medical Necessity. Not surprisingly, this is a common reason given by UPIC when denying skin substitute claims. UPIC auditors often contend that skin substitute products fail to meet applicable medical necessity directives set out under the relevant MAC’s LCD. For example, one of the medical necessity requirements set out under CGS Administrator’s LCD L36690 is that a review of the medical records must reflect:

“Documentation (in the pre-service record) specifically addressing circumstances as to why the wound has failed to respond to standard wound care treatment of greater than 4 weeks and must reference specific interventions that have failed.” (Emphasis added).

When denying skin substitute claims based on lack of medical necessity, UPICs often cite the basic Medicare definition and frequently argue that skin grafts or tissue products lack medical necessity, based on Medicare’s definitions in CMS’s Program Integrity Manual, Chapter 13, §13.5.4.[17]

- Inadequate Wound Assessment and History. In recent UPIC audits, the contractors have been quick to deny skin substitute claims based on a provider’s failure to fully document the baseline conditions of a patient’s wounds. Prior to initiating treatment, providers should fully document the severity of the wound (length, width, and depth). Providers should also ensure that a complete history, including conservative treatment of the wound, is maintained so that progress can be reviewed and improvements in the wound can be documented.

- Billing and Coding Errors. In an audit, UPICs regularly find that the number of applications documented in a patient’s medical record differs from the number billed to Medicare. Treatment durations lasting longer than 12 weeks have been cited as excessive and have been denied by UPICs.

- Treatment Plans and Notes Are Not Patient Specific. Sales representatives working for wound care product vendors are often quick to share sample treatment plans and progress notes with providers. Using these generic treatment plans and notes is a quick way to have your claims denied by UPIC auditors. While each patient and his or her wound care needs are unique, there are a number of core requirements discussed in the LCD that must be demonstrated in a skin substitute draft treatment plan. Taking these core requirements into account, providers should endeavor to tailor care plans and base each treatment regimen on each patient’s specific needs.

- Product Qualifies as Experimental or Investigational. If a skin substitute product is considered experimental or investigational, it will not be considered medically necessary.[18] Furthermore, off-label uses of skin substitute products will not be covered. As an example, LCD L36690 provides:

“All listed products, unless they are specifically FDA-labeled or cleared for use in the types of wounds being treated, will be considered not reasonable and necessary, therefore not eligible for reimbursement.” (Emphasis added).

- Use Exceeds Number of Applications and / or Period of Care Authorized Under an LCD. For example, the LCD L36690 imposes strict limits on the number of applications of a skin substitute product that may be used during a period of care. As LCD L36690 states:

“Simultaneous use of more than one product for the episode of wound is not covered. Product change within the episode of wound is allowed, not to exceed the 10 application limit per wound per 12 week period of care.”

C. Office of Inspector General (OIG) Audits.

While the Office of Inspector General (OIG) operates under the “general supervision” of the Secretary of HHS, it exercises a high degree of statutory independence.[19] This independence is designed to ensure objective oversight, free from political pressure by HHS management. Exercising independent oversight over its cases, the OIG conducts audits and investigations, and, when appropriate, refers cases to the Department of Justice (DOJ) for civil enforcement and / or criminal prosecution.

Notably, OIG has a long history of auditing wound care supplies and skin substitute products. In fact, the OIG first expressed concern regarding wound care supplies more than thirty years ago. In a trifecta of separate, but related reports published by the agency in October 1995, the OIG detailed that approximately two-thirds of Medicare’s payments for wound care supplies during the period audited were questionable.[20] From November 1995 through August 2025, the OIG issued several reports addressing wound care-related issues.[21]

Most recently, in September 2025, the OIG issued a report titled “Medicare Part B Payment Trends for Skin Substitutes Raise Major Concerns About Fraud, Waste, and Abuse.” [22] Unfortunately, this report has only reinforced the fact that there appear to be serious medical necessity, documentation, coding, and billing deficiencies when it comes to skin substitute claims. The OIG’s September 2025 report has called for changes to the current payment methodology and reiterated the need for enhanced enforcement to reduce fraud and improper payments. Specific concerns covered in the OIG’s September 2025 report include:

- New providers (i.e., those who recently received a National Provider Identifier) for whom almost 100 percent of their claims are for skin substitutes with no other associated wound care management.

- Providers who are submitting multiple skin substitute claims for a single date of service to circumvent Medicare claims processing systems that reject any claim above $99,999.99.

- The use of skin substitutes for non-approved conditions (e.g., minor scrapes or blisters) or with an excessive quantity for the given condition (e.g., total body surface treatments).

- The consistent use of skin substitutes during enrollees’ first visit without attempting prior conservative treatments.

- Provider specialties that seem out of scope for the treatment (e.g., a neurologist or psychiatrist billing for skin substitutes).[23]

D. U.S. Department of Justice (DOJ) Prosecutions.

As reflected above, the OIG, CMS’s Fraud Defense Operations Center, and a wide variety of CMS contractors have been conducting skin substitute audits of wound care provider claims around the country. While most of these audits are handled administratively, when evidence of billing fraud or violations of the Anti-Kickback Statute is identified, referrals are made to law enforcement for evaluation and possible prosecution. Collectively, the OIG, CMS, and its proxies have made a significant number of referrals to the DOJ for evaluation and possible prosecution. Examples of criminal prosecutions and civil cases brought under the False Claims Act are discussed below:

Criminal Prosecutions

California. In this case, a California podiatrist who purchased skin graft products from a sales representative was alleged to have permitted the sales representative, who was not a licensed health care provider, to apply the skin grafts to Medicare and Medi-Cal beneficiaries. The podiatrist then submitted the claims to these government payors for payment and falsely represented that it was the podiatrist who actually applied the skin grafts. After receiving payment from the payors based on these false claims, the podiatrist then made payments to the sales representative. Ultimately, both the podiatrist and the skin graft sales representative pleaded guilty to “Conspiracy to Commit Health Care Fraud.” Sentencing is still pending. Both defendants face a maximum penalty of 10 years in prison and a $250,000 fine.

Arizona. An Arizona husband and wife pleaded guilty to causing more than $1.2 billion in false and fraudulent claims to Medicare and other health benefit insurance programs for medically unnecessary wound grafts that were applied to elderly and terminally ill patients. The government alleged that the defendant wife contracted with untrained sales representatives who were tasked with locating elderly patients, including hospice patients, who had wounds at any stage. The government further alleged that the defendant wife “financially incentivized” the sales representatives to order amniotic wound grafts only in sizes 4x6 centimeters or larger, even if the wound was much smaller. Notably, the wound grafts were only to be ordered from a specific graft distributor. The government contends that the companies run by the defendant wife received over $279 million in illegal kickbacks from the distributor of the grafts. Last month (October 2025), the defendant wife was sentenced to more than 15 years in prison. Her defendant husband was sentenced to 14 years in prison.

Nevada. In this case, the government prosecuted a Las Vegas nurse practitioner alleging that she applied medically unnecessary amniotic wound allografts to Medicare beneficiaries that were procured through illegal kickbacks and bribes. The defendant admitted that her wound care company fraudulently billed the Medicare program more than $14 million. As of November 2025, sentencing remains pending. The defendant is facing up to five years in prison.

Texas. Earlier this year, as part of a nationwide health care fraud “take-down,” a Texas podiatrist and the CEO of a local medical clinic were indicted in a $90 million Medicare skin substitute fraud scheme. The government has alleged that the skin substitute products were ordered for patients, some of whom did not have qualifying wounds, or in some instances, any wounds at all. Notably, the government contends that the defendants’ skin substitute claims were audited in 2023 and subsequently warned that their billing was improper. Nevertheless, they continued to bill Medicare for skin substitute products. The government has further alleged that the defendants “falsified medical records to make it appear patients had chronic wounds and manipulated documentation to show those wounds were improving despite no such existing conditions.” The government’s allegations have yet to be proven and remain pending. The defendants are presumed innocent unless ultimately convicted through due process of law.

Civil False Claims Act Prosecutions

Florida. In this instance, one of the nation’s largest providers of bedside specialty wound care, servicing patients in nursing homes and skilled nursing facilities, was sued under the False Claims Act for allegedly causing the improper submission of claims to the Medicare program. To resolve these False Claims Act allegations, the defendants agreed to pay the government $45 million. The specific improper conduct alleged by the government included:

- The government alleged that the defendant companies billed the Medicare program for surgical excisional debridement procedures that were either not medically necessary or were not performed.

- The government alleged that the defendant companies “pressured, trained, and provided financial incentives for the defendant’s physicians” to perform debridement procedures during as many patient visits as possible, even if the procedures were not needed.

- The government alleged that the defendant companies programmed their Electronic Health Record / Billing Software so that higher-reimbursed surgical excisional procedures would be billed.

- The government alleged that individuals at the defendant companies created false medical record documentation to support the improper billing scheme.

Florida. In July 2025, a dermatology practice and associated ambulatory surgery center agreed to pay more than $840,000 to resolve allegations that the defendants violated the False Claims Act by “knowingly causing the submission of falsely coded claims to Medicare for wound repair procedures.” Both defendant organizations performed wound repair procedures following a patient's Mohs micrographic surgery. In this case, the government contended that the defendant organizations engaged in upcoding and falsely coded “linear repairs” as if they were “flap repairs.” The defendant organization was also alleged to have falsely coded smaller flap repairs as if they were larger in size.

When investigating wound care fraud cases under the False Claims Act, DOJ prosecutors will typically issue a Civil Investigative Demand (CID) to a wound care practice. Under 31 U.S.C. § 3729-3733(1)(A)-(D), the government can use a CID to require a person or organization to: (1) Produce documentary materials for inspection and copying, (2) Answer written interrogatories, and / or (3) Give oral testimony concerning the allegations presented. Notably, wound care / skin graft substitute False Claims Act investigations can easily expand to cover other provider billing practices and can lead to a number of adverse collateral consequences. For a more detailed discussion covering the government’s use of CID, please see our article that is linked in the endnote below.[24]

III. What Does the Future Look Like for Skin Substitute Products?

On October 31, 2025, CMS released the Final Rule for the 2026 Medicare Physician Fee Schedule.[25] The Final Rule was published in the Federal Register on November 5, 2025. Among the 1200+ pages of provisions covered by the Final Rule, there are significant changes outlined that will impact the way that skin substitutes will be covered and paid as of January 1, 2026. Simply put, Medicare will no longer pay for skin substitute grafts under specific product biologic codes. Instead, all skin substitute applications will be paid at a flat rate of approximately $127/cm, regardless of which product was used. Moving forward, many wound care providers have expressed considerable concerns regarding the new payment methodology that will be used. As CMS recently wrote:

“CMS currently treats skin substitutes as biologicals for the purposes of Medicare payment. In the CY 2026 PFS final rule, CMS will pay for skin substitutes under the PFS as incident-to supplies, a change expected to reduce Medicare spending on these products by nearly 90% without compromising patient access or quality of care. We estimate this action will reduce gross fee-for-service program spending for skin substitute services by $19.6 billion in 2026, while incentivizing the use of products with the most clinical evidence of success.” [26]

Even though Medicare payments for skin substitute products are anticipated to fall precipitously in 2026, these products will likely remain under the audit microscope throughout the coming year. This is primarily because program integrity contractors and law enforcement will continue to initiate skin substitute audits based on claims submitted and paid in 2025 (and earlier) to wound care providers for these products.

In addition to these changes to the payment methodology that will apply to skin substitute claims, CMS is initiating a pilot program in 2026 that will effectively require prior approval for skin substitute products and a variety of other high-end services, even though the targeted plan is traditional, fee-for-service Medicare. This pilot program is known as the WISeR audit initiative. For additional information regarding the WISeR audit initiative, please see our recent article cited at the footnote below.[27]

IV. Frequently Asked Questions (FAQs) with Respect to Skin Substitute Claims:

After representing wound care providers in multiple audits and investigations of skin substitute claims, there are a number of questions that are often asked by clients. Many of these Frequently Asked Questions (FAQs) are set out below:

- Why have CMS and its MACs proposed significant changes to existing LCDs covering skin substitute grafts and tissue-based products? Effective January 1, 2026, new skin substitute graft LCD guidance will become effective. As an example, Novitas Solutions LCD L35041, titled “Skin Substitute Grafts/Cellular and Tissue-Based Products for the Treatment of Diabetic Foot Ulcers and Venous Leg Ulcers” has been published and is poised to go into effect. Setting aside the significant cost issues (which are undoubtedly the primary reason that CMS will be implementing a new payment methodology), CMS has also expressed concern that a number of the current use and application practices have not been properly peer-reviewed, and their efficacy has been questionable. As LCD L35041 expressly states:

“Despite lack of definitive improved health outcomes in the Medicare population, coverage will be provided for skin substitute grafts/CTP that have peer-reviewed, published evidence supporting their use as an adjunctive treatment for chronic ulcers shown to have failed established methods of healing,”[28]

These new coverage and payment requirements set out in LCD L35041 are intended to protect patients who need to benefit from these skin substitute products while establishing revised standards that are intended to restrict coverage to only those situations that have been shown through peer-reviewed evidence to support their medical use.

- What can trigger a Medicare audit of my skin substitute graft claims? Medicare audits of skin substitute claims are often triggered by unusual billing patterns (such as a high volume or frequency of skin substitute graft or tissue-based claims), excessive payments, discrepancies in site of service, lack of documentation, rapid expenditure growth, or data analytics identifying outlier behavior.

- What will happen if I fail to respond to a request for documentation in a timely fashion? Unfortunately, the failure to respond to an audit and / or document request remains one of the recurring reasons cited by UPICs when denying claims. In recent years, the failure to respond to a CMS request for documents has become especially risky in light of CMS’s expanded list of reasons it may cite when revoking a provider’s billing privileges. The collateral consequences of improperly handling a UPIC audit can literally put your practice into bankruptcy.

V. Reducing Your Wound Care Practice’s Level of Enforcement Risk:

Unfortunately, you can’t change the past. If you and your practice have billed a significant amount to Medicare for wound care services and / or skin substitute grafts, there is a significant likelihood that one (or more) of the audit contractors or investigative agencies discussed in Section II will target your claims for review. Nevertheless, going forward, there are a number of steps you can proactively take to reduce your level of risk.

In light of the substantial coverage and payment changes that will be effective as of January 1, 2026, it will be helpful if wound care providers place audit requests into two categories: (1) Dates of Service prior to January 1, 2026, and (2) Dates of Service on or after January 1, 2026. The coverage and payment rules governing these two periods are quite different and will likely involve different defenses, arguments in support of payment, and documentation considerations. Nevertheless, there are a number of core requirements that must be met. These include, but are not limited to, the following:

- Confirm that the Application of Skin Substitute Grafts is Medically Necessary. Under the Social Security Act, medically necessary services and supplies are those that are “reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member."[29] At the outset, it is important to keep in mind that medical necessity and coverage are two separate issues. A provider may determine that it is medically necessary and appropriate to treat a patient’s wound with a skin substitute graft, despite the fact that a particular application does not meet the coverage requirements set out in the reviewed LCD.

- Document Prior Conservative Treatment Efforts / Take Baseline Measurements / Monitor Progress (or Lack Thereof). At the outset, you should document the cause of the wound, when it first arose, the severity and the impact of any prior conventional treatments (including a description of the failed prior treatment efforts). You need to note how long other treatment efforts have been attempted and show that more skin substitute grafts were needed in light of the failure of less intense treatment efforts. Ultimately, the medical record must support the clinical decision to move beyond conservative treatment efforts and apply skin substitute grafts. Prior to initiating treatment, wound care providers need to fully document the baseline measurements of the wound to be treated, including but not limited to all of the relevant dimensions (length, width, depth). Date-stamped photographs documenting the severity of the wound can be essential in showing medical necessity.

- Know the Rules Governing Coverage and Payment. Recent audits of wound care providers submitting skin substitute claims to Medicare repeatedly found that providers failed to comply with the medical necessity, coverage, and documentation requirements set out in existing LCDs.On January 1, 2026, updated LCDs will become effective. As a review of the revised LCDs will show, CMS and its MACs have interspersed a wide variety of “coverage requirements” throughout the guidance. Frankly, the new guidelines are extraordinarily complicated and will likely require more than one review to fully digest their provisions. Therefore, over the next month, wound care providers and their clinical staff must familiarize themselves with the new guidance to better ensure compliance. For instance, is the patient’s wound a qualifying diabetic foot ulcer or a venous leg ulcer? If not, it is not addressed by the new LCD guidance. Moreover, there are a multitude of requirements that must be fully documented in order to show that the treatment meets “Standards of Care” (SOC) requirements. Treatment plans developed and implemented must address a number of factors. Similarly, wound care providers should ensure that the Progress Note covering each treatment application is comprehensive and documents the skin substitute product name, manufacturer, and any lot or serial numbers. You should also document any skin substitute wastage that occurs, setting out why wastage was necessary.

- Significant Changes to the Coverage of Skin Substitute Products are on the Horizon. One of the primary reasons given by CMS for updating the current LCD and delaying the effective date of the revised LCDs was to give the agency and its contractors additional time to consider additional peer-reviewed evidence prior to finalization. As a review of the pending LCD reflects, the results of multiple studies examining skin substitute grafts were reviewed and evaluated in an effort to identify products that have been shown to be efficacious and reflect supported evidence-based support in the studies conducted. Prior to using a particular skin substitute graft product, providers must confirm that the product to be applied qualifies for coverage. For example, Novitas LCD L35041 includes three tables listing skin substitute products that are to be covered vs. non-covered. These tables include the following:

- Table 1 -- Evidence for Covered Products for DFUs. As Table 1 shows, the list of approved skin substitute graft products covered by Medicare has been restricted to 17 for diabetic foot ulcer (DFU) treatments.

- Table 2 -- Evidence for Covered Products for VLUs. The list of approved skin substitute graft products in Table 2 has been reduced to only five for the treatment of venous leg ulcers (VLUs).

- Table 3 -- Evidence for Non-Covered Products. As Table 3 in LCD L35041 reflects, a substantial list of skin substitute graft products has been evaluated and found to have insufficient evidence for coverage of DFUs and VLUs.

- Skin Substitute Audits are Inevitable. Internal Monitoring is Essential to Compliance. Wound care providers need to be proactive when it comes to monitoring medical necessity, documentation, billing and coding compliance. You shouldn’t wait to be audited before you check whether you are on the right track. Should you identify claims that do not qualify for coverage and payment, promptly refund any overpayments identified.

- If Your Skin Substitute Claims are Audited, Contact an Experienced Health Lawyer for Assistance. As reflected by Section II above, the range of assessments and penalties that can result from a skin substitute audit is quite broad. Overpayments, False Claims Act damages, and criminal prosecutions can result from these audits and investigations. When you first receive a request for documents (whether in the form of a letter request or a subpoena), you should engage a health lawyer who is experienced in responding to skin substitute matters and cases.

VI. Conclusion – Responding to an Audit of Your Skin Substitute Claims:

Wound care providers will face several new medical decision-making and business challenges in 2026. In light of the newly restricted list of covered skin substitute products that will be effective as of January 1, 2026, it is imperative that you review your current medical necessity, documentation, billing, and coding practices to ensure that you are fully complying with the new rules. Realistically, wound care providers should expect to remain under the microscope of CMS contractors and law enforcement. Audits will continue to be initiated and pursued by the government. If your skin substitute claims are audited, you need to have an experienced health lawyer in your corner. The attorneys at Liles Parker have extensive experience representing providers and suppliers in Medicare audits and investigations. Please schedule an initial complimentary consultation with expert health care attorneys at Liles Parker.

Ashley Morgan and Meaghan DeBenedetto are attorneys with the health law firm, Liles Parker. They are both experienced healthcare attorneys and hold certifications as a Certified Professional Coder (CPC). Their practices are concentrated exclusively on healthcare law and particularly on the appeal of claim denials, regulatory guidance, and compliance planning.

Both Ashley and Meaghan have represented practices in wound care and skin substitute claims audits. Are your skin substitute claims being audited? Call an attorney who regularly handles these types of complex Medicare claims appeals. For a free initial consultation with Liles Parker, click here.

- [1] To his credit, Daniel DeFoe (author of “Robinson Crusoe”), first published this saying in his 1717 publication “Fair Payment No Spunge: Or, Some Considerations on the Unreasonableness of Refusing to Receive Back Money Lent on Publick Securities. And the Necessity of Setting the Nation Free from the Insupportable Burthen of Debt and Taxes.” (London, 1717). As DeFoe wrote, there is a:

“. . . a Proverb or by-Word among us, that there is nothing sure, but Death and Taxes.” (Emphasis added).

- [2] For an overview of prior investigations and government enforcement efforts, we recommend you review our August 2022 article titled “Amniotic Fluid / Amniotic Membrane Tissue Audits, Investigations and Prosecutions are Continuing to Climb in 2022.” In August 2024, we updated our review of the government initiatives and covered them in our article titled “Navigating Amniotic Tissue / Amniotic Membrane / Skin Substitute Audits and Investigations.”

- [3] As reported on the Centers for Medicare and Medicaid Services (CMS) website less than a month ago:

“Medicare spending on wound care products known as “skin substitutes” has had unprecedented growth, rising from $256 million in 2019 to over $10 billion in 2024, according to Medicare Part B claims data. This dramatic spending increase is largely attributed to abusive pricing practices in the sector, including the use of products with limited evidence of clinical value.“ (Emphasis added).

- [4] See OIG’s latest report is titled “Medicare Part B Payment Trends for Skin Substitutes Raise Major Concerns About Fraud, Waste, and Abuse” OEI-BL-24-00420, (September 2025)(Page 1).

- [5] For example, see: Novitas Solutions, LCD L35041, “Application of Bioengineered Skin Substitutes to Lower Extremity Chronic Non-Healing Wounds.” Wisconsin Physicians Service Insurance Corporation, LCD L39865, “Skin Substitute Grafts/Cellular and Tissue-Based Products for the Treatment of Diabetic Foot Ulcers and Venous Leg Ulcers,” CGS Administrators LLC, LCD L36690 “Wound Application of Cellular and/or Tissue Based Products (CTPs), Lower Extremities., and First Coast Service Options, LLC, LCD L36377, “Application of Skin Substitute Grafts for Treatment of DFU and VLU of Lower Extremities.”

- [6] For an overview of the TPE audit process, please see our article titled "TPE Audits: The Process & Expected Targets in 2023."

- [7] While helpful, the checklist published by First Coast is incomplete and does not fully cover a number of the denial reasons we are seeing in wound care audits. We recommend you consult with a health care lawyer who is experienced in defending these types of claims to ensure that the documentation you submit for the MAC’s review is complete.

- [8] First Coast’s checklist for wound debridement claims is helpful but once again, providers should exercise caution when using it. There are a number of other points that may need to be documented to fully document medical necessity.

- [9] Compliant “Incident-To” billing has been a problem for health care providers for over 30 years. Among its many changes (especially to the billing and reimbursement of skin substitute grafts), the “Calendar Year (CY) 2026 Medicare Physician Fee Schedule Final Rule (CMS-1832-F)” also modifies the “direct supervision” definition applied in “Incident-To” billing situations. As CMS recently noted in a Fact Sheet covering the 2026 Physician Fee Schedule Final Rule:

“We are also finalizing, for services that are required to be performed under the direct supervision of a physician or other supervising practitioner, to permanently adopt a definition of direct supervision that allows the physician or supervising practitioner to provide such supervision through real-time audio and visual interactive telecommunications (excluding audio-only).”

While CMS is effectively expanding the scope of direct supervision, health care providers should remain cautious before billing for “Incident-To” services. Numerous requirements must be met for these services to be appropriately billed. For additional information on “Incident-To” billing, see our article titled “Incident To Billing Practices are Under Law Enforcement’s Microscope. Are Your Incident-To Billing Practices Compliant?"

- [10] See First Coast’s topic list titled “Targeted Probe and Educate (TPE) Topics and Schedule of Review” for Surgical Services.

- [11] Noridian is currently auditing surgical dressing claims as part of Project 01-136. As the project description states: “Coverage is provided for primary and secondary surgical dressings used on the skin on qualifying wound types such as a wound caused by, or treated by, a surgical procedure or after debridement of the wound.”

- [12] Noridian previously conducted a medical review of Mohs surgical procedures billed to Medicare under Project 01-095.

- [13] RACs perform post-payment reviews and are paid on a contingency fee basis for their work. The way that RACs are paid is different from that of other program integrity contractors (which are typically paid on a contract basis).

- [14] Automated audits by RACs use data analysis to identify obvious errors like duplicate claims or incorrect coding. In contrast, complex audits typically involve a medical review of the patient’s medical records to check for issues like medical necessity and proper documentation.

- [15] See CMS Program Integrity Manual, Section 4.1.

- [16] CGS Administrators, LCD L36690, “Wound Application of Cellular and/or Tissue-Based Products (CTPs), Lower Extremities.”

- [17] Medicare Program Integrity Manual, Chapter 13, Section 13.5.4 -- Reasonable and Necessary Provisions in LCDs. As this section provides, a contractor LCD can only cover an item or service if it is reasonable and necessary under 1862(a)(1)(A) of the Social Security Act.

- [18] There is a narrow exception to this prohibition. For example, under LCD L36690, the “routine costs of qualifying clinical trial services with dates of service on or after September 19, 2000, that meet the requirements of the Clinical Trials NCD are considered reasonable and necessary.”

- [19] The HHS Office of Inspector General (OIG) was originally established in 1976 under the Department of Health, Education, and Welfare (HEW). It was established as part of Public Law 94-505 and was signed into law by President Ford.

- [20] The Office of Inspector General (OIG) first issued a trifecta of reports, analyzing the billing of wound care supplies and expressing concern regarding the propriety of the associated billing to the Medicare program. These reports include: (1) “Questionable Medicare Payments for Wound Care Supplies” OEI-03-94-00790, (October 1995), (2) “Questionable Medicare Payments for Wound Care Supplies” OEI-03-94-00791. (October 1995), and (3) “Wound Care Supplies: Operation Restore Trust” OEI-03-94-00792, (October 1995).

- [21] Three wound care related reports issued during the period November 1995 through August 2025 include: (1) “Medicare Payments for Negative Pressure Wound Therapy Pumps in 2004” OEI-02-05-00370. (June 2007), (2) “Comparison of Prices for Negative Pressure Wound Therapy Pumps” OEI-02-07-00660. (March 2009), and (3) “Some Skin Substitute Manufacturers Did Not Comply with New ASP Reporting Requirements,” OEI-BL-23-00010, (March 2023).

- [22] The OIG’s latest report is titled “Medicare Part B Payment Trends for Skin Substitutes Raise Major Concerns About Fraud, Waste, and Abuse” OEI-BL-24-00420, (September 2025).

- [23] titled “Medicare Part B Payment Trends for Skin Substitutes Raise Major Concerns About Fraud, Waste, and Abuse” OEI-BL-24-00420, (September 2025)(Page 8).

- [24] Please see our article titled “Civil Investigative Demands (CIDs) & Collateral Enforcement Risks: A Review.”

- [25] The complete title of the Final Rule is the “Medicare and Medicaid Programs; CY 2026 Payment Policies Under the Physician Fee Schedule and Other Changes to Part B Payment and Coverage Policies; Medicare Shared Savings Program Requirements; and Medicare Prescription Drug Inflation Rebate Program.” 90 Fed. Reg. 49266 (November 5, 2025).

- [26] CMS Newsroom Press Release titled “CMS Modernizes Payment Accuracy and Significantly Cuts Spending Waste.” (October 31, 2025).

- [27] See our recent article titled "Overview of the WISeR Model: How Should Your Practice Respond?"

- [28] Novitas Solutions LCD L35041, titled “Skin Substitute Grafts/Cellular and Tissue-Based Products for the Treatment of Diabetic Foot Ulcers and Venous Leg Ulcers” (Revised Effective Date -- For Services Performed On or After 01/01/2026).

- [29] See Section 1862(a)(1)(A) of the Social Security Act.